The private sector was the source of this decline in investment, as the Labour government’s Budget of 2009/2010 temporarily increased public investment. The incoming Coalition government immediately brought that to a halt. What is striking is that the decline in investment is now led by the contraction in publicinvestment. In fact the whole of the ‘double-dip recession’ of three consecutive quarters of falling GDP is accounted for by the sharp fall in public investment.

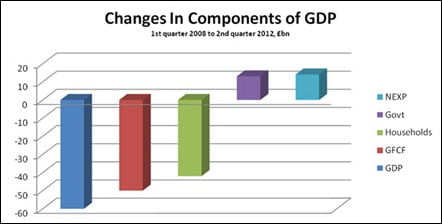

This is shown in Chart 2 below. This is the same format as the previous chart but it covers the time period from when the Coalition came into office. In addition it separates the two sources of investment, public and private. The data for these are taken from Schedule F of the latest quarterly national accounts.

Chart 2

Over the period to date of the Coalition government, the economy has contracted by £5.6bn. And the main driving force is the sharp contraction in public investment which has fallen by £11.2bn, almost twice the fall in GDP. Private investment has actually increased by £4bn over the same period.

It is noteworthy that household spending has also fallen by an amount greater than the fall in GDP, down by £8.6bn and reflects the effects of ‘austerity’, the cuts in welfare and other payments, the public sector wage freeze, and the decline in real wages because of high inflation. Off-setting these to some extent have been the rise in government current (as against investment) spending, and the increase in net exports.

In a very direct sense the latest contraction in the British economy is a function of government policy. It is a recession made in Downing Street.