By Michael Hudson, with Dirk Bezemer, Steve Keen and Sabri Öncü

This article first appeared in Naked Capitalism on 10th April 2020

Summary

After being attacked by monetarists and others for many decades, MMT and the idea that running government budget deficits is stabilizing instead of destabilizing is suddenly gaining applause from the parts of the political spectrum that long opposed MMT: the banking and financial sector, especially the Republicans. But what is applauded is in many ways something quite different than the leading MMT advocates have long supported.

Modern Monetary Theory (MMT) was developed to explain the logic of running government budget deficits to increase demand in the economy’s consumption and capital investment sectors so as to maintain full employment. But the enormous U.S. federal budget deficits from the Obama bank bailout after the 2008 crash through the Trump tax cuts and Coronavirus financial bailout have not pumped money into the economy to finance new direct investment, employment, rising wages and living standards. Instead, government money creation and Quantitative Easing has been directed to the finance, insurance and real estate (FIRE) sectors. The result is a travesty of MMT, not its original aim.

By subsidizing the financial sector and its debt overhead, this policy is deflationary instead of supporting the “real” economy. The effect has been to empower the banking sector, whose product is credit and debt creation that has taken an unproductive and indeed extractive form.

This can clearly be seen by dividing the private sector into two parts: The “real” economy of production and consumption is wrapped in a financial web of debt and rent extraction – real estate rent, monopoly rent and financial debt creation. Recognizing this breakdown is essential to distinguish between positive government deficit spending that helps maintain employment and rising living standards, as compared to “captured” government spending to subsidize the FIRE sector’s extraction and debt deflation leading to chronic austerity.

Origins and policy aims of MMT

MMT was developed to explain the monetary logic in running budget deficits to support aggregate demand. This logic was popularized in the 1930s by Keynes, based on his idea of a circular flow between employers and wage-earners. Deficit spending was seen as providing public employment and hence consumer spending to absorb enough production to enable the economy to keep producing at a profit. The policy goal was to maintain (or recover) reasonably full employment.

But production and consumption are not the entire economy. Modern Monetary Theory (MMT) was formally developed in the 1990s, with roots that can be traced by Abba Lerner’s theory of functional finance, and by Hyman Minsky and others seeking to integrate the financial sector into the overall economic system in a more realistic and functional way than the Chicago School’s monetarist approach on the right wing of the political spectrum. A key point in its revival was Warren Mosler’s insight that a currency-issuing country does not “tax to spend”, but instead must spend before its citizens can pay tax in that currency.

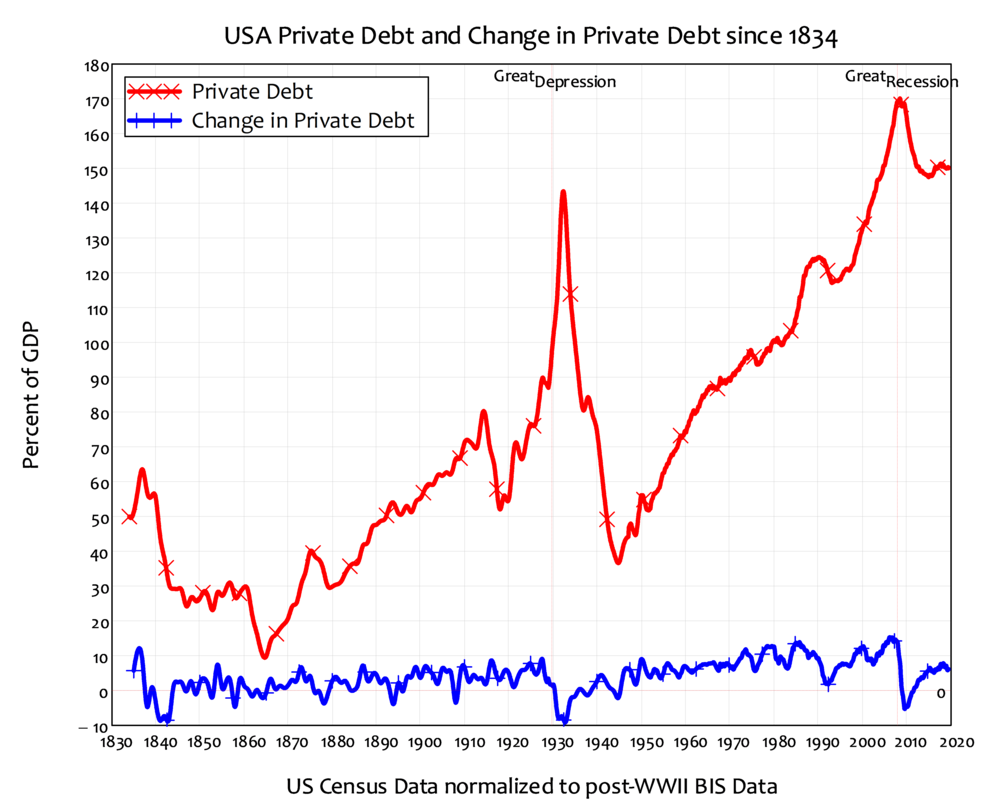

MMT was also Post-Keynesian in the sense of advocating government budget deficits as a means of pumping purchasing power into the economy to achieve full-employment. Elaboration of this approach showed how such deficits created stability instead of the instability that results from private-sector debt dynamics. At an extreme, this approach held that recessions could be cured simply by deficit spending. Yet despite the enormous deficit spending by the U.S. and Eurozone in the wake of the 2008 crash, the overall economy continued to stagnate; only the financial and real estate markets boomed.

At issue was the role of government in the economy. The major opponents of public enterprise and infrastructure, of budget deficits and market regulation, was the financial sector. “Austrian” and Chicago-style monetary theorists strongly opposed MMT, asserting that government budget deficits would be inflationary, citing Germany’s Weimar inflation of the 1920s, and Zimbabwe, and portraying government deficits (and indeed, active government programs and regulation) as “interference” with “free markets.”

MMTers pointed out that running a budget surplus, or even a balanced budget, absorbed income from the economy, thereby shrinking demand for goods and services and leading to unemployment. Without government deficits, the economy would be obliged to rely on private-sector banks for the credit needed to grow.

That occurred in the United States in the final years of the Clinton administration when it actually ran a budget surplus. But with a public sector surplus, there had to be a corresponding and indeed identical private sector deficit. So the effect of that policy was to leave either private debt financing or a trade surplus as the only ways in which economic growth could obtain the monetary support that was needed. This built in structural claims for interest and amortization that were deflationary, ultimately leading to the political imposition of debt deflation and economic austerity after the 2008 debt crisis.

Republican and financial sector opposition to budget deficits and MMT

If governments do not provide enough purchasing power by running budget deficits to enable the economy to grow, the role of providing money and credit will have to be relinquished to banks – at interest, and for purposes that the banks decide on (mainly, loans to buy real estate, stocks and bonds). In this respect banks are competitors with government over who will provide the economy’s money and credit – and for what purposes.

Banks want the government out of the way – not only regarding money creation, but also for financial and price policies, tax policy and laws governing corporate behavior. Finance wants to appropriate public monopolies, by taking payment in natural resources or basic public infrastructure when governments are, by policy rather than necessity, short of their own money, or of foreign exchange. (In times past, this required warfare; today foreign debt is the main lever.)

To get into this position, banks need to block governments from creating their own money. The result is a conflict between private bank credit and public money creation. Public money is created for social purposes, primarily to maintain production and consumption growth. But bank credit nowadays is created largely to finance the transfer of property and financial assets – real estate, stocks and bonds.

Opposing the logic for running budget deficits

The Reagan-Bush administration (1981-82) ran budget deficits not to pay for social spending, but as a result of tax cuts, above all for real estate.[1] The resulting budget deficit led to proposed “cures” in the form of fiscal cutbacks in social spending, starting with Social Security, Medicare and education. This aim became explicit by the Clinton Administration (1993-2000), and President Obama convened the Simpson-Bowles “National Commission on Budget Responsibility and Reform” in 2010. Its name reflects its recommendation that “responsibility” meant a balanced budget, which in turn required that social spending programs be rolled back.

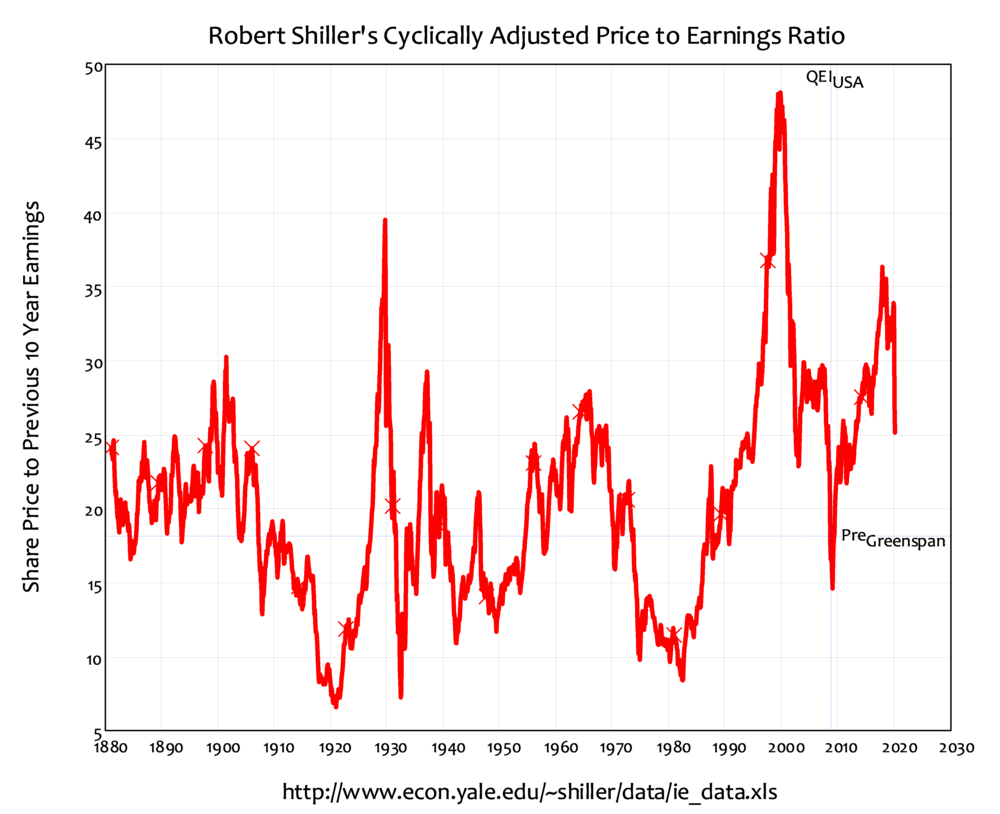

Opponents of public spending programs saw the rise in government debt resulting from budget deficits as providing a political leverage to enact fiscal cutbacks in spending. Many Republicans and “centrist” Democrats had long sought a reason to scale back Social Security. Austrian and Chicago-School monetarists urged that government shrink its activity, privatizing as many of its functions as possible to let “the market” allocate resources – a largely debt-financed market whose resource and monetary allocation would shift away from governments to financial centers – from Washington to Wall Street, and in other countries to the City of London, the Paris Bourse and Frankfurt. However, no such critique was levied against military spending, and the government responded to the 2000 dot.com and 2008 junk-mortgage financial crises by enormous monetary subsidy and bailouts of the economy’s credit and asset sector.

The Obama and Trump financial bailouts as a travesty of MMT

To advocates of MMT, and indeed to most post-Keynesian economists, the positive function of budget deficits is to spend money and therefore income into the economy. And by “the economy” is meant the production-and-consumption sector, not the financial and property markets. That “real” economy could have been saved in a number of ways. One way would have been to scale back mortgage debts (and debt service) to realistic market prices and rent rates. Another would have been simply to create monetary grants and subsidies to enable debtors to remain in their homes. That would have kept the financial system solvent as well as employment and existing home ownership rates.

But Obama double-crossed his voters by not rolling out bad mortgage debts and other obligations to realistic market prices, and instead bailing out the banks for credit creation in the form of bad loans (“liars’ loans” to NINJA borrowers), and bad financial bets on derivatives by brokerage firms that were designated as “banks” in order to receive Federal Reserve credit and bailouts. With bank balance sheets impairing their ability to create new credit, the government stepped in by creating its own credit. This gave the banks, shadow banks and other non-bank financial institutions a bonanza of credit – replete with the opportunity to buy up foreclosed homes and create rental properties. This policy was organized by Blackstone, and turned the crisis into an opportunity to make enormous rates of return for its participants. The effect was to intensify the economy’s polarization, as investors typically needed a minimum $5 million tranche to join.

The Federal Reserve’s $4.6 trillion in Quantitative Easing did not show up as money creation, because it was technically a swap of assets – like Aladdin’s “new lamps for old, in this case “good credit for junk.” The effect of this swap was much like a deposit inflow. It enabled banks to ride out the downturn while making a killing in the stock and bond markets, and to lend for takeover loans and related financial speculation.

Wall Street’s Financial capture of MMT to inflate asset prices, not revive the economy

At issue is how to measure “the economy.” For the wealthy One Percent, and even the Ten Percent, “the economy” is “the market,” specifically the market value of the assets that they own: their real estate, stocks and bonds. This property and financial wrapping for the “real” production-and-consumption economy has steadily risen in proportion to wages and industrial profits. It has risen largely by government money and credit creation (and tax breaks for property and finance), along with its economic rent, interest and financial charges and service fees, which are counted as part of Gross Domestic Product [GDP], as if they were actual contributions to the “real” economy.

So we are dealing with two economic spheres: the means of production, tangible capital and labor on the one hand (what is supposed to be measured by GDP), and the market for financial and property assets, along with their rentier charges that are taken from the income earned by this labor and real capital.

Financial engineering replaces industrial engineering – along with political engineering by lobbyists seeking tax breaks, rent-extraction privileges, and government subsidy. To increase property and financial asset prices and corporate behavior, companies are drawing on credit and government subsidy not to increase their production and employment, but to bid up their stock prices by share buyback programs and high dividend payouts. Buybacks are called “repaying capital,” so literally this policy is one of disinvestment, not investment. It is favored by tax laws (taxing “capital” gains at a lower rate or not at all, as compared to taxes on dividends).

The blind spot of vulgarized MMT: The FIRE sector vs. the “real” economy

Much superficial confusion between the FIRE sector and the production-and-consumption economy comes from repeating the over-simplification of classical monetary formula MV=PT, namely, dividing the economy into private and government sectors. Setting aside the balance of payments (the international sector), it follows that government spending will pump money into the domestic economy, and that conversely, budget surpluses will suck money out.

The problem is that this analysis, used by many MMTers, for instance, the Levy Institute’s typical chart, does not distinguish between government spending into the FIRE sector and asset markets as compared to spending into the “real” economy on employment and production (including the building of public infrastructure, for instance). Without this distinction it is not possible to see whether deficit spending is productive by aiming at supporting employment and output, or merely aims at supporting asset prices and making sure that creditors do not lose the value of their financial claims on debtors – claims that have become unpayable and thus are a bottomless pit of government deficit spending in the end.

Trying to keep the financial sector and its debt overhead afloat implies imposing austerity on the rest of the economy, IMF-style. So “MMT for Wall Street” is an oxymoron, and is the opposite of MMT for a full employment economy.

MMT, public and private debt

Money is debt. Government money creation for public purposes – to pay for employment and output – spurs prosperity. But in its present form, private-sector debt creation has become largely extractive, and thus leads to the opposite effect: debt deflation.

Governments can pay public debt without defaulting, as long as this debt is denominated in their own domestic currency, because the governments can always print the money to pay. To the extent that public debt results from spending that supports output, employment and growth, this process is not inflationary. The government gives value to money by accepting it in payment of taxes. So the monetary system is inherently bound up with fiscal policy. The classical premise of such policy has been to minimize the economy’s cost structure by taxing mainly unearned income (economic rents), not wages and profits in the production-and-consumption sector.

The problem nowadays is private debt. Most such debt is created by banks. This bank credit – debts owed by bank customers – tends to increase faster than the ability of debtors to earn enough income to pay it. The reason is that most of private debt is not used for productive, income-generating purposes, but to finance the transfer property ownership (affecting asset prices in proportion to the rate of credit growth for such purposes). That use of credit – not associated with the production-and-consumption economy – leads to debt deflation. Instead of providing the economy with purchasing power (as in running government budget deficits), private debt works over time to extract interest and amortization from the economy, along with servicing fees.

2 responses

"Higher housing costs require new home buyers to take on more and more debt in order to buy a home. Their higher debt service leaves less disposable income to spend on goods and services."

Fed figures actually show household debt service costs as being lower now than at any time in the last 40 years. See:

https://fred.stlouisfed.org/series/TDSP

Excellent! But then I expected nothing less from these authors!