The Wall Street Journal reported over the weekend (but not as a great surprise) that US GDP is likely to fall in the first Quarter – before the main impact of the coronavirus hit – at the fastest rate since the global financial crisis:

“This is just the beginning,” said Beth Ann Bovino, S&P Global’s chief U.S. economist, who estimates that GDP dropped at a 7.5% annual rate in the first quarter.

Also not surprisingly, the WSJ predicted far worse for April, and thus for Q2, and reminded of the extraordinary sudden rise in unemployment in the States:

“By the end of March, over 10 million workers had filed claims for unemployment benefits, a number that grew to more than 26 million in the week ended April 18”.

We in PRIME have been looking at the likely path for GDP this side of the Atlantic, starting from the Office for National Statistics’ data for UK real GDP to date, taking into account the Office for Budget Responsibility’s “scenario” for 2020, and making some assumptions, covering both supply and demand and their interplay, which I hope are not too unreasonable. The UK is likely to fare even worse economically than the US.

Our conclusions for the year – though by a somewhat different route – come pretty close to the OBR’s “scenario”. We estimate that over the whole year, GDP will fall by over 14% compared to 2019; the OBR suggest 13%. Like the OBR, our prognostication at this point is more pessimistic than most commentators (see the list provided by H.M. Treasury recently, in which only Société Générale had foreseen a fall of over 10%). We think that economists generally have been far too sanguine about the likely path. And even the OBR’s scenario has the implausible reservation that “For now, we have not assumed the shock has lasting economic consequences.”

Unless (magically) the Covid 19 virus simply disappears, there seem to be whole sectors that are bound to be badly affected, and hard to replace in the short term (e.g. by redirecting into other sectors, and/or by on-shoring) with alternative ‘production’ of goods or services. Moreover, though some (better off) will benefit from increased savings during the lockdown, those who lose work, temporarily or permanently, will for sure be forced to ‘consume’ less, and reduce overall demand. And some of the easiest and most popular forms of consumption (restaurants, bars, holidays, many forms of entertainment) will suffer from blocked means of supply.

And let us not forget that UK household debt remains stubbornly high, so available finance may be spent as much on reducing debt as on a new round of consumer spending. In its Global Debt Monitor of November 2019, the International Institute of Finance have a table showing by country the level of household and other sector’s stock of debt as a percentage of GDP. At 83.4% in Q2 2019, the UK was the most indebted country listed, save for South Korea. (As GDP falls, this ratio will surely worsen). The average for “mature markets” was 72%.

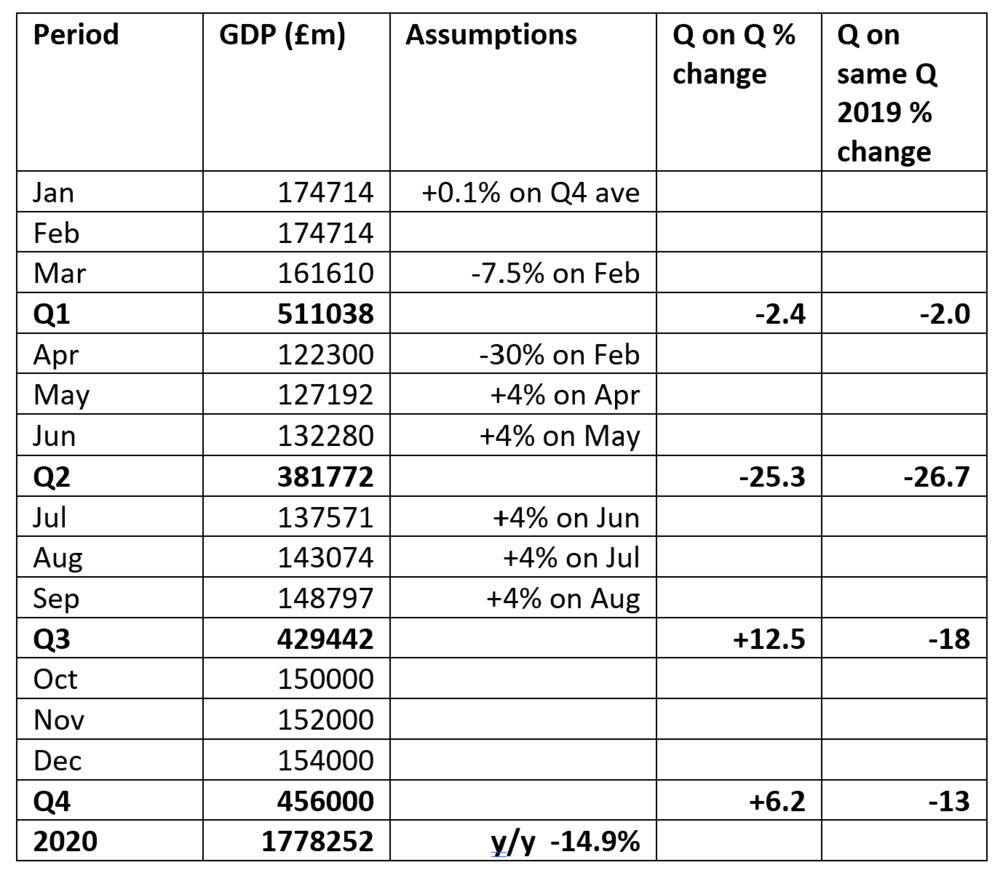

Our approach to making an estimate for GDP is to look at the presently available GDP monthly figures from ONS for January and February, adding just around 0.1% to GDP over the Q4 average per month. For March, noting the start of the lockdown on 23 March (but with many businesses starting to wind down even sooner) we assume a fall of 7.5% from the February figure. This all (taking the 3 months) makes a Q1 fall of 2.4% on Q4 2019.

We then assume that output in April is down 30% from the February level (i.e. the last relatively ‘normal’ month). Thereafter, we assume that output will very gradually build back, as a result of (a) some businesses achieving more output even within the lockdown, and (b) some gradual progressive relaxation of the lockdown scope. We therefore build back an assumption of month by month increase of 4% in real terms on the previous month. This lasts to September.

This together makes:

a Q2 fall of 25.3% on Q1, and a year on year Q2 fall of 26.7%.

a Q3 rise of 12.5% on Q2, but a year on year Q3 fall of 18%.

For Q4, we have taken some broad figures which build in a more modest monthly increase, so that GDP in Q4 is 6.2% higher than in Q3. This more limited rate of increase is because it seems extremely probable that large areas of the economy will still not be able to function at anything like the ‘old’ level, if at all – notably in food, accommodation, travel, retail etc. As a result, the year on year Q4 figure then shows a fall (compared to Q4 2019) of 13%.

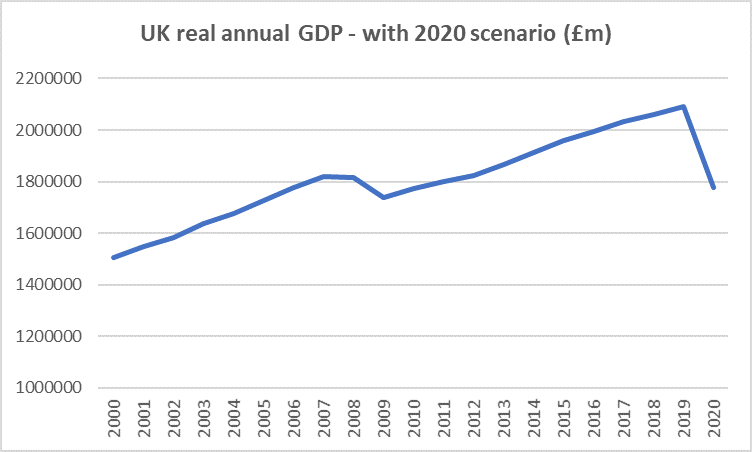

Finally, the full year-on-year estimated figures (based on all the above assumptions) indicate that GDP for 2020 would be £1,778,252 million, compared to the total for 2019 of £2,089,519 million. This means GDP in 2020 being a huge 14.9% lower than in 2019. (Table 1 at the foot of this article sets out the month by month and Quarter by Quarter figures for our estimates.)

This would be by some distance the largest ever annual fall in GDP, the only one within range having been in 1921, when it is estimated to have dropped by 9.7%. On that occasion, unemployment (of the insured workforce) leapt from 2% to 11% in a year, and remained high till World War 2.

On our assumptions, GDP for 2020 would be (in real terms) at about the same level as 2006/7, and 2011. (See our chart at the head of this article, including our estimation for 2020).

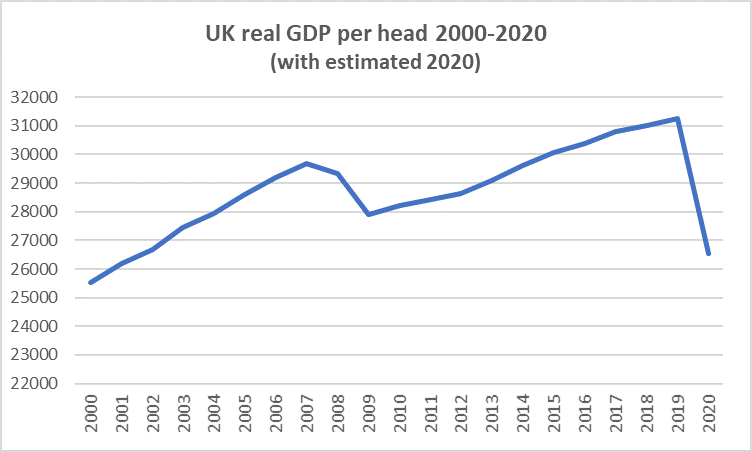

However, as the UK’s population generally increases by some 0.6 to 0.8% per year, the population will have grown considerably since 2011, and of course by more since 2007. Therefore in terms of GDP per head, 2020 would be – on our assumptions – the lowest since 2001 (£26,541 for 2020, based on population of 67m, to compare with £26,189 in 2001, and £31,263 in 2019). This next chart shows the position starkly:

source: ONS, with our own estimation for 2020