By Michael Burke

Despite government assertions that the NHS spending was being ‘ring-fenced’ it is now widely understood that real spending reductions are taking place, even if government speakers describe them as £20bn of ‘efficiency savings’.

The character of the NHS is undoubtedly being altered, with the government seeking a far greater role for the private sector. The scope of that role is, however, circumscribed by the political situation – and this is what it has now paused to reassess.

In assessing the degree of spending reductions to the NHS budget in real terms, three factors need to be taken into account:

- Government data are presented in nominal (cash) terms, not real terms

- Therefore the level of inflation needs to be included in calculations – and this is usually greater in medical equipment, drugs, etc., than in economy-wide inflation

- The population is both growing and ageing, which means that real medical spending would have to increase simply in order to keep with the natural rise in demand

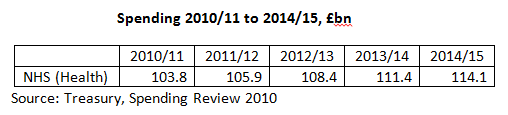

With those factors in mind, it is clear that government spending reductions are deep in real terms. From the Comprehensive Spending Review of October 2010, the Resource Departmental Expenditure Limits are shown in Table 1 below (Table A.9, p.85).

Table 1:

spending 2010.2011

To take the current financial year (FY), spending is set to rise by 2.0% compared to the spending in FY 2010/11, even though RPI inflation is currently running at 5.5%. In fact, the total level of spending on the same measure under the last Labour government in the FY 2009/10 was £103bn (Treasury, Budget 2010, Table 2.2, p.43). By the end of the current FY this government will have been in office for just under two years. Over that time spending on the NHS will have risen from £103bn to just £105.9bn, or 2.8%. According to the Office of Budget Responsibility, RPI inflation will have risen by a cumulative 10% over the same period (OBR, Economic and Fiscal Outlook, March 2011, Table 4.3, p.95). This represents a decline in real spending of 7.2% in just two years.

This continues so that over five years nominal NHS spending is projected to rise from £103bn to £114.4bn, or fractionally over 11%. At the same time, the OBR projects that inflation will have risen by 22%, representing a real decline of 11%.

According to the OECD health spending tends to increase internationally by around 1.5% per year over the long run, because of growing and ageing populations as well as the higher inflation rate of medical processes. If that long-run international pattern applies to Britain over the 5-year period, the additional real spending required would increase by 7.7%.

The government spending reductions to the NHS are therefore nearly 19% in real terms compared to normal trends over the lifetime of this Parliament.

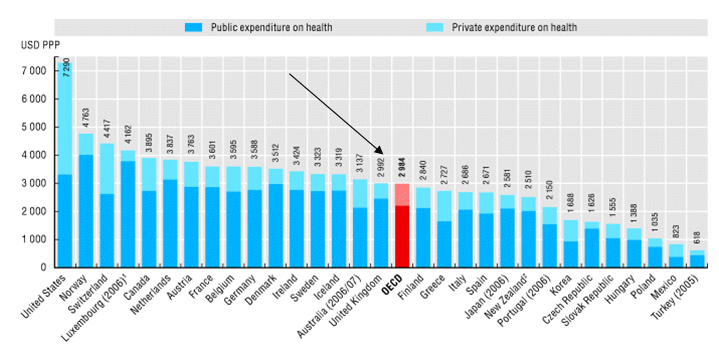

Figure 1 below is taken from the OECD’s ‘Health At A Glance’ 2010. It shows the per capita health spending for the OECD countries in comparable US$ Purchasing Power Parity terms.

Figure 1:

healthcare_spending_private_public

Health spending in Britain is already well below the average of its peer group in the richest OECD economies. Government real-terms spending reductions will take it to below the OECD average as a whole.

The US has the highest proportion of private provision and its total healthcare costs are off the chart – even though 45 million Americans have no healthcare insurance, compared to the universal system for the NHS. For 2007 (latest data) the US spent 16% of GDP on healthcare, whereas Britain spent 8.4% (OECD, 2009). Yet there is the same ratio of health workers in the workforce and life expectancy at birth is higher in Britain.

This article is based on research and information first posted on the Socialist Economic Bulletin >