This article by Professor Ioannis Theodossiou, of the Centre for European Labour Market Research (CELMR), University of Aberdeen Business School, forms part of the author’s full paper, which can be downloaded here in pdf format.

Since 2010 the European Commission, the IMF and the Greek and European political establishment have imposed a full blown internal devaluation programme that in Greece has caused a depression unlike any seen in Europe since WWII. The main drivers of the programmes have been an exaggerated and cruel implementation of the neoliberal policy agenda, including cuts in wages and pensions, increases in taxation, total relaxation of any collective agreement, redundancies for public sector employees, the fire sale of public assets at fire prices and severe cuts in funding for an already underfunded health system.

These deflationary policies have been lately reinforced with an even more outrageous policy prescription for an economy in severe depression, namely the requirement of a Primary Surplus, i.e. the attainment of excess of revenues over expenditures net of interest payments. Though this surplus is destined to pay the creditor countries one should expect that it would cause a further reduction of the purchasing power of the Greek citizens over and above the decline associated with the earlier battery of internal devaluation policies.

The European economic and political elite, in supporting these policy prescriptions, argued that since over the pre-2010 decades the Greek economy suffered low productivity, these policies would redress the balance by curtailing spending – private and public – and somehow promote market confidence. In turn, the increased confidence would increase investment and thus outweigh the contractionary effects of austerity.

Almost ten years of strict implementation of these policies has created only despair for the Greek nation. The Greek national debt – the reduction of which was supposed to be the reason for these policies in first place – increased from around 109% in 2008 to almost 180% of GDP in 2015 . Meanwhile the country’s GDP has declined by more than 25% over the same period and the Gross Fixed Capital Formation as percentage of the GDP (GFCF) has uniformly fallen from 26.0 in 2007 to 11.7 in 2015.

The unemployment rate has increased from 11% to over 23% after reaching a peak of 28% and youth unemployment after reaching an extraordinary 60% is still around 44%. The destruction of the Greek economy is best highlighted by the reports regarding rising inequality and poverty. Greece has the largest increase in income inequality (before taxes and transfers) in Europe since 2010 which is now the highest in the EU.

The policy debate in Greece and the EU is burdened with hysteria over the issue of budget deficit and public debt. The proposition is that the less the governments borrow the better and, therefore, the main policy has been to put pressure on the State to curtail as far as possible all capital expenditure, without concern on how productive and desirable that is in itself. The idea is that cuts in government expenditures are not to be used by the government to tax the general population less but to borrow less on the assumption that if the government borrows less the private sector necessarily borrows more, though taxing less the highest rungs of the income distribution might be desirable as it is considered as an incentive to investment.

Second, led by the belief that the main thrust of policy should be internal devaluation, a program of cutbacks in expenditures, decrease in deficits and debts and wage and income restraint is pursued even in a time of recession.

The idea is that if producers have reduced costs of production they will produce more and the prices of the produced goods will fall as much as wages. However, as Keynes pointed out that there is no reason to expect that any reduction of purchasing power will be offset by increases in other directions. Certainly, this reduction of purchasing power may cause a reduction of domestic expenditures on imports, which may improve the trade balance. It may also reduce savings, as public employees and others whose salaries are cut and those who lost their jobs may save less or draw on their passed savings to maintain their habitual standard of life.

However, producers will find that the expenditures of consumers (public employees, pensioners, unemployed) are reduced. Consequently, they can only match this reduction of revenue by either cutting down their own expenditure or making redundant some of their employees or both. As a necessary consequence of reduced incomes and profits there should be an increase in unemployment and a decrease in government tax revenues.

Effects on Lenders and Borrowers

Importantly, as Keynes noticed, deflation of wages, incomes and prices transfers wealth from the rest of the public to the rentiers and to those who hold titles to money. In effect, internal devaluation redistributes wealth as it transfers money from borrowers to lenders. The real assets in the country constitute the wealth of its citizens. Such real assets are buildings, stocks of commodities, goods in the process of production and the like. As is the usual practice, owners of these assets frequently purchase them by borrowing money.

So to the number of borrowers there is always a corresponding number of lenders. The lenders own the money used by the borrowers – the asset owners – for the purchase of these assets. This money is usually obtained though the commercial banking system. Thus, in effect, the banks assure the depositors who lent the money to the bank that their money will be paid back on demand. This promise is given on the assumption that the borrowing customers will honour the terms of the loan and pay back the money used to buy their real assets.

However, a change in the value of money affects the relative position of those who possess claims to money and those who owe money. A decrease in prices and wages is equivalent to an increase in the value of claims on money. Hence real wealth is transferred from the debtors to the creditors since a larger proportion of the real assets is represented by the claims of the depositor (the lender) and a smaller proportion goes to the owner of the asset who has borrowed money to buy the real asset.

In short, the real value of the loan increases for the creditor and the real burden of the debt increase for the borrower. Hence, debt service is a higher proportion of debtors’ incomes, and there is a reduction or even elimination of the borrowers’ margins of equity. This disqualifies them from further access to credit. Hence, debtor bankruptcies and defaults follow as a vicious circle sets in. This transmits the distress of debtors to their creditors which threatens the solvency and liquidity of the lenders and financial institutions.

Effects on the Banking Sector

The above is only the first round effect of deflation of prices and wages. The second round effect comes from the position of the commercial banks between the borrower and the lender as they owe money to their depositors whose money is lent to the borrowers. Banks give a guarantee to their depositors of getting back the money on demand but without any concern on the worth of money. Indeed, small downward fluctuations in the value of money have no repercussions for the banks as it is a common practice for them to allow for small decreases in the price of real assets by financing only a part of the initial purchasing price of the asset. This ‘margin’ protects the bank in ordinary circumstances where the downward change in the money value of the assets is within conventional limits.

But this guarantee to the lender can be honoured only if the money value of the asset that the borrower has purchased remains constant or fluctuates within narrow limits over a significant period of the loan. When in a brief period of time the money value of the asset declines excessively in a way that exceeds the set margin the bank is unprotected. A severe decline in the money value of the real assets, as this experienced the recent years in Greece and elsewhere in the EU, jeopardises the whole banking structure. There is a degree of deflation in the price of real assets which cannot be endured by any bank and the Greek banks are a case in point.

Effects on expectations

As devaluation of wages and prices takes its course and there is a gradual rise in the value of the country’s money in terms of the goods it announces to every producer that in the future any stock held in goods or raw materials will steadily depreciate and to everyone who has borrowed to finance the business that the real value of the loan will steadily increase. In view of this any sensible producer will postpone any orders as long as possible and any sensible borrower will prefer to go out of business rather than borrow. Furthermore any sensible citizen will turn any asset in his or her possession into cash and wait for the appreciation of its value.

Thus, as pessimism sets in the circulation of money is expected to fall which will further intensify the slowing down of the economic activity. As Keynes put it ‘a probable expectation of deflation is bad enough; a certain expectation is disastrous’. Indeed, the whole economic activity can be brought to a standstill as it is the case in Greece although the rest of the EU suffers from the same disease.

Say’s law: when doctrines defy logic

The classical tradition proposes that internal devaluation policies benefit the community as a whole by reducing the cost of production which in turn induces the producers to increase the volume of production and hence employment. This is because the costs are what the producer pays the employed labour for the production and the produced product prices determine the producer’s income when the products are sold. For the community as a whole, the producers get back as sales proceeds the same amount that they have paid out to the employed labour in the course of production since this is the income of the public which they use to buy the products produced. Thus, supply creates its own demand.

This Keynes denied. He argued that it is not true that what producers pay out as costs of production necessarily returns back to them as the sales proceeds of what they produce.

‘It is a delusion to suppose that they [producers] can necessarily restore equilibrium by reducing the total costs whether it be by restricting output or cutting rates of remuneration;… For the reduction of their outgoings may, by reducing the purchasing power of the earners who are also their customers, diminish their sale –proceeds by a nearly equal amount’ .

Why then does the total cost of production fall short of the total sale proceeds? To answer this it is instructive to briefly outline Keynes’ explanations as they appear in his ‘Treatise of Money’ which precedes his masterpiece, The General Theory.

Keynes starts from the premise that the total costs of production – which is also the total earnings of the community – are divided in some proportion between the cost of production of consumer goods and the cost of production of capital goods. The incomes of the public (the total earnings) are also divided in some proportion between the expenditures on consumer goods and on savings. Overall, if the proportion of the cost of production on consumer goods is larger than the proportion used by the public to purchase consumption goods then the producers of consumption goods will receive less sale proceeds than their production outlays. Hence they incur losses.

However, the profits of the producers of consumption goods will be reinstated only if the proportion of the income that the public spends on consumption goods increases (i.e. the public saves less) or if a larger proportion of production is dedicated to capital goods (since this reduces the proportion of production devoted to consumption goods). However, capital goods cannot be produced in a higher proportion unless the producers of such goods foresee that are going to make a profit. Hence, the issue lies in identifying the determinants of the profits of the producers of capital goods. Clearly, they depend on whether the public prefers to keep their savings as cash or use them to buy capital goods. If the public does not buy capital goods then the producers of capital goods are set to make a loss. Hence less capital goods will be produced. If so then the producers of consumption goods will make a loss. In the end, all producers will make a loss. This will cause a rise in unemployment and a vicious circle will start.

This simplified picture of the production–expenditure process highlights the essential variable in Keynes’ analysis of new capital investment. The fundamental cause of the recession or slump is the insufficient output of new capital investment.

So in view of this, why is there an insufficient output of new capital goods today? In my view this is due to a number of combined circumstances.

First, the fall in incomes and prices has been catastrophic to those who have borrowed and anyone who has postponed new capital investment and business initiatives has gained by the postponement.

Second, the lack of sufficient demand generated by the austerity policies exacerbated the reluctance of the producers of capital goods to borrow.

Third, both the European Central Bank policy of cheap money and the shift of wealth from the low and middle incomes to the top have affected the preferences of the lenders towards speculative use of funds and encourage them to take part in Stock Exchange speculation.

Fourth, in view of the borrowers’ reluctance to borrow, instead of financing new investment the savings of the lenders are being used up either on occasion to finance business losses and distress borrowers to meet losses which they have incurred through the fall in prices thus extracting exploitative rates of return or to finance labour saving devices which under normal conditions would have been considered unviable. This exacerbated unemployment and lack of demand.

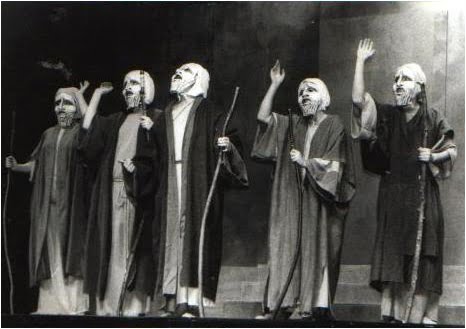

Is there an Exode in this Greek Tragedy and the European Stagnation?

Any recovery is inseparably tied up with the re-establishment of both the purchasing power of the public and the restoration of demand at higher levels and importantly with establishing a higher volume of new capital investment. This should involve first, maintaining low interest rates and second, the return of confidence to the business world so inducing favourable expectations for the future so they are confident in investing in new capital. However, confidence cannot return without the experience of improvement in business profits; but business profits cannot return without the increase in new investment relative to savings.

An increase in investment relative to savings can only take place first, when there is a rise in prices thus improving the ability of reducing the monetary indebtedness as the alleviation of the debts or at least the writing down of debts to match the market value of the assets can go a long way to restoring confidence and second, when favourable expectations to the businessman are built up regarding the future yield of a unit of new capital asset compared to the current production cost of this unit of capital asset, that is an improvement of the Marginal Efficiency of Capital. The question then becomes what methods can be implemented to increase the volume of investment which is the expenditure of money on the output of new capital goods.

In the current state of affairs there are two ways to this end: The first is the restoration of confidence in business prospects so that businessmen have a reasonable prospect of earning sufficient return from a new capital investment. However, restoration of confidence cannot be based on unclear hopes and rhetoric but on real improvement in the demand for goods and services. This result can be achieved only along a second scheme.

This scheme consists of a total reversal of the current policies and a drive for new public capital investment under the direct auspices of the State or other public authorities.

To be clear at this point; new capital goods investment does not mean raising revenues by the government selling state assets through privatisations. Classical thinkers such as John Steward Mill viewed State assets such as port, water, electricity, railway companies, the hospitals and the universities as entities which are not supposed to operate for profit but rather to establish an infrastructure in the country conducive to providing a stable and low cost environment for all citizens and the business world within which they could pursue their interests. Privatisation not only negates this vital purpose but in addition introduces monopoly power in the market since most of State assets are to an important degree natural monopolies and it is well known that private monopolies are detrimental to market functioning.

Second, when a country sells its assets, its net worth is decreased with long term consequences. Importantly the country not only does not own the asset but it also forgoes any yields arising from its ownership and it furthermore it results in increases in its costs outlays when buys back the services or goods that the forgone asset provided. This is counterproductive to the road to recovery.

Should government forsake active intervention?

The government should take active role in establishing new capital investment. Contrary to the current policy prescriptions the government should set up an authority whose business should be to make sure that detailed plans are prepared for new capital investment to be undertaken directly by the State. Thus the port, water, electricity, railway companies, the local authorities, the hospitals and the universities and other entities should be asked to investigate and then detail the projects that could be usefully undertaken if capital were available so projects can be launched. This was Keynes’ advice for the road to prosperity during the 1930s and his advice is fully applicable today. It is also noteworthy that investments in health and education are the most valuable and effective part of the public investment programme as they lead to a more efficient and dynamic economy

Importantly, new capital investment can be further encouraged if the government enacts legislation to facilitate the establishment of worker cooperatives backed up by access to favourable credit facilities to establish new business or to turnaround indebted private companies. The establishment of worker cooperatives give an alternative to the capitalist enterprise and provide an alternative model of economic regeneration where workers and their communities can decide what to produce, where to produce, how to produce and what do with the profits. MONDRAGON Corporation, the co-operative corporation in the Basque Country and other similar worker cooperatives are models to aspire in this respect .

The government revenues required for this extensive government intervention can be secured by fair and strictly progressive taxation. The extraordinary increase in the degree of inequality is an outcome of government policy in terms of what it does and what it does not do. Much of the income accumulated at the top end of the income distribution is not one based on individuals’ contributions to society but is instead rents captured by the inappropriate rules including tax breaks and tax exemptions, exploitation and monopoly power –notwithstanding corruption. This has transferred income from the bottom and the middle to the top over several of the past decades. This trend should be reversed . Indeed, if there is an

‘undue concentration of incomes and probably a resulting tendency to over-saving’ if a more equal distribution ‘were achieved mainly at the expense of reducing a volume of savings so swollen that a considerable part of it goes to waste, the change would be very nearly a clear gain’. (J. M Clark, 1934).

Progressive taxation will mobilise inactive savings and reverse the trend of transferring income from the bottom and the middle to the top, providing revenues for the active government intervention and increase demand for goods and services as it places income with those with high propensity to spend their money on for domestically produced goods and services, thus enhancing demand.

Contrary to the current policy prescriptions, the times for reducing the deficit and the debt are boom times not times of slump and recession. Thus, as Keynes urged amidst the Great Depression, the government should borrow from its own citizens in order to spend in building prosperity. This undoubtedly increases the nation’s debt. But as Keynes also pointed out, the debt of a nation to its own citizens is a very different issue from the debt of an individual or debt to non-national entities. The citizens comprise the nation and to owe money to them is like owning money to one’s self. In so far as interest payments will have some adverse redistribution effects as wealth to the lenders this is a disadvantage, but it is a small matter compared with the importance of facilitating the establishment of general prosperity.

In summary, if the private individuals are unwilling to spend in new capital investment then it is essential the government does it for them. But there is no justification for not doing it at all. Apart from the humans costs of the austerity policies outlined earlier Franklin D. Roosevelt has warned us:

‘We have come to a clear realization that true individual freedom cannot exist without economic security and independence. People who are hungry and out of a job are the stuff of which dictatorships are made’

The central message of this essay is the vital necessity for the efforts to recovery to be well-orchestrated, well programmed by the strategic intervention of the government to increase he economic activity. As Keynes put it

‘I expect to see the State … taking an ever greater responsibility for directly organising investment… a somewhat comprehensive socialisation of investment will prove the only means of securing an approximation to full employment’ (Keynes 1936).

Is this programme towards prosperity feasible for Greece or other EU countries within the EU; whether inside or outside the Eurozone? The answer to this is left to the reader’s judgment.

The author is grateful to PRIME’s Ann Pettifor and Jeremy Smith for their valuable comments and suggestions. Any remaining errors or omissions are the author’s responsibility.