By Michael Burke

George Osborne has told the BBC that there will be £40bn in ‘credit easing’ so that small firms can obtain both cheaper and more readily available loans. Osborne has called the scheme a ‘game-changer’. If the funds had the stated impact, of increasing investment by small and medium-sized enterprises (SMEs), then it would certainly provide a significant lift to the economy. £40bn is equivalent to 2.8% of GDP.

The strength of this overblown rhetoric may be judged by the fact that there are widespread reports that the Office for Budget Responsibility is set to slash its growth forecasts for 2012 to just 1% from 2.5% previously.

How is it that significant funds for new investment by business will actually lead to no improvement in the outlook for growth, even on the usually over-optimistic forecasts from the OBR?

There are to be at least two, possibly three funds. The first will be guarantees to increase the availability of credit. The second will be a fund to lower the cost of that credit to SMEs. Since SEB continually argues for increased investment, surely this is a good thing?

Private Sector Failure

Even official forecasts do not assume that growth will significantly improve as a result of this policy. This highlights the fallacy that underlies all current attempts to persuade, cajole, demand or bribe private firms to increase their investment. The fallacy is that those firms are struggling under the burden of insufficient funds to invest. Of course certain individual firms may have such difficulties. But in aggregate that is not the case.

In a previous bulletin SEB showed that in 2010 the total Gross Operating Surplus of the business sector in Britain was £475bn. These are akin to profits. Yet the entire level of investment (Gross Fixed Capital Formation) was just £214bn in 2010. As this includes the investment by both private individuals and government, it is clear that businesses have vast resources already from which they could increase investment.

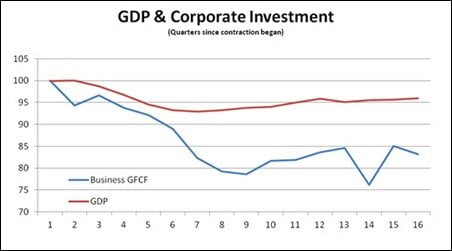

The chart below shows the decline in total Gross Fixed Capital Formation (GFCF) and corporate sector GFCF. Both these measures of investment began falling one quarter before the recession itself began. The fall in both at their low-point in the 4th quarter of 2010, of over 20%, is approximately three times as great as the fall in GDP of at 7.1%. Both chronologically and arithmetically the decline in investment, led by declining business investment, led the recession.

Fig. 1

wed_nov_30_chart_1

Both measures of investment have experienced a small recovery. Business investment began to rise in the 1st quarter of 2010. This was two quarters after both total investment and GDP began to rise in the 3rdquarter of 2009.

Private sector investment led the recession. But it cannot lead the recovery. This is demonstrated in the chart below, which shows corporate GFCF and GDP.

wed_nov_20_chart_2