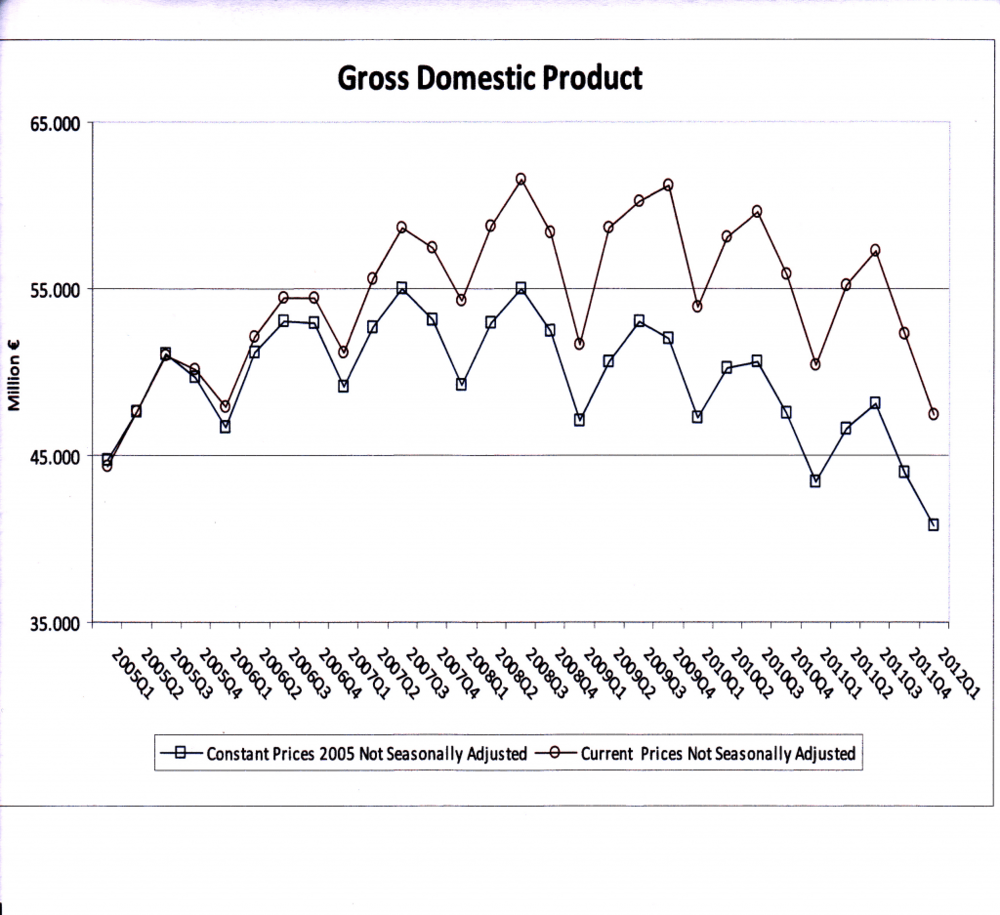

The Greek Q1 figure is the lowest for many years, at €40761 (2005 constant prices). It is 6.19% lower than Q1 the year before, and stands 17.13% below the peak Q1 figure of 2008 (€49188). That is, Greek economic activity has declined by over one-sixth in 4 years.

On GDP, the Eurostat figures show that one country (Portugal) has had quarter-on-quarter declines for the last 4 quarters. Four countries now show Q-on-Q declines for the last 3 quarters (Czech Republic, Italy, Cyprus, Netherlands), whilst the UK has its two-quarter double-dip. Slovenia and Ireland will probably join the “negative 3 quarter club” once their Q1 figures are in. Italy’s sequence of -0.2, -0.7, -0.8 is especially worrying. And Greece is only excluded by virtue of its extreme cyclicality and lack of seasonal adjustment. But the divergences are acute. From Q4 2011 to Q1 2012, Finland shows growth of 1.3%, Slovakia and Lithuania 0.8%, and Germany 0.5%. At the ‘top’ of the negative end are the Czech Republic (-1.0%) and Italy (-0.8%).

Compared with Q1 2011, six countries showed an increase of over 1.0%, whilst eight countries recorded a lower level of GDP, with Greece (-6.2%), Italy (-1.3%), Spain (-0.4%) and Portugal (-2.2%) being joined by the Czech Republic (-1.0%), Cyprus (-1.4%), Hungary (-1.5%) and the Netherlands (-1.3%).

Trade winds of change

But in a strange way, Greece and Germany are currently, by intention or default, following a similar trade strategy which involves a strong turn away from the single market and their European partners.

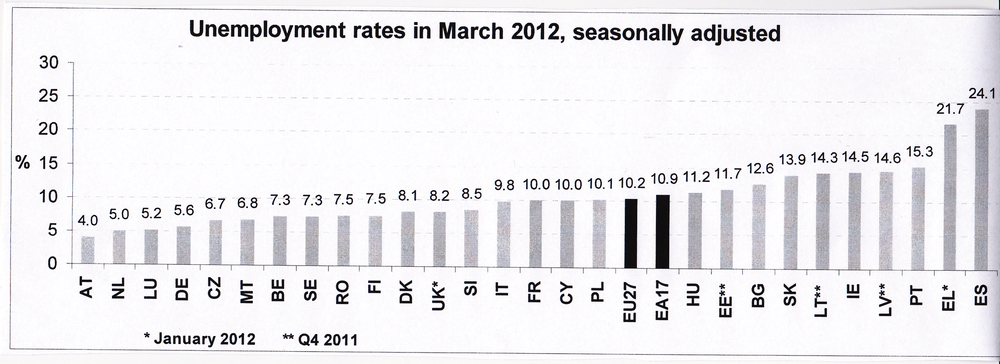

Germany we know is a big exporter, and it is still powering ahead, thanks in part to the lower Euro value. Most of its exports are still to Europe – in 2011, 39.7% to the Eurozone, 19.5% to the rest of the EU, and 11.7% to other non-EU parts of Europe. But this is rapidly changing. The following graph, from the German Federal Statistics Office, shows the changes in German export and import shares between 2010 and 2011. There is a slight increase to France and Poland, but the increases – from modest bases – to China and Russia are striking. Meanwhile, Germany is exporting less (as a %) to the troubled economies of Greece, Portugal, Italy and Spain, plus Belgium.

german import export changes 2010 11