This article is cross-posted from the Credit Writedowns Pro website, first published earlier today, 11 May. You can follow Edward Harrison on Twitter @edwardnh

Germany is a member of a currency union over which it has no monetary authority. So no one can accuse the country of ‘manipulating’ its currency. Yet, Germany is displaying huge current account surpluses that are illustrative of a dangerous imbalance which when corrected will cause violent disruptions to trade and lead to populist and autarkic political rhetoric. This is what awaits us when the global economy slows further.

The John Maynard Keynes Plan of 1941 for dealing with trade imbalances is highly relevant to both east Asian countries with high current account surpluses accumulating US dollar reserves and to Germany, which is part of a fixed-rate currency union without monetary sovereignty. If you recall, Keynes saw British post World War I deflation as the result of an imbalance between a British debtor and US creditor though the gold standard was supposed to automatically correct current account imbalances by draining gold reserves from countries with international debtor positions. But unfortunately, there is an asymmetry in all creditor-debtor relationships including this one, because – As Keynes put it – adjustment is “compulsory for the debtor and voluntary for the creditor”.

Therefore, during the second world war, when a new currency system was being proposed, the Keynes Plan was to create a clearing union using an international currency, the Bancor, that would stop creditors from sterilizing their current account surpluses because they would be charged punitive rates of interest for doing so. Conversely, the debtors would be given cheap loans through a Bancor overdraft facility. This arrangement would, therefore, use market forces to create greater symmetry in the incentives for both debtors and creditors to stop imbalances.

But of course this plan did not win the day because at the battle of Bretton Woods, the US representative Harry Dexter White won the day, installing a system with the US anchored to gold and everyone else anchored to the US dollar. If we fast forward to today, the US dollar is still the world’s main reserve currency. And so the desire to accumulate it for reserve balances requires the US run a current account deficit to match the current account surpluses of reserve-accumulating countries. Clearly this causes tension in a post-Asian Crisis world in which emerging market countries of all stripes are desperate to avoid the fate that befell Asia in the late 1990s when countries were caught short of US dollar reserves. The US sees this imbalance legacy of the crisis and of the US dollar’s reserve status as currency manipulation. And when the US economy turns down, it leads to anti-trade rhetoric that will eventually end in restrictions.

At the same time, we have a different actor with a similar policy agenda in Europe, namely Germany. The Germans – and to an even greater degree, the Dutch, have export-led economies. But since Germany is much larger and has more pull within the eurozone, most economists focus on Germany. Pre-financial crisis, the export-led model resulted in a sort of intra-European vendor financing scheme between the core and the periphery. Here’s how I put it in 2010:

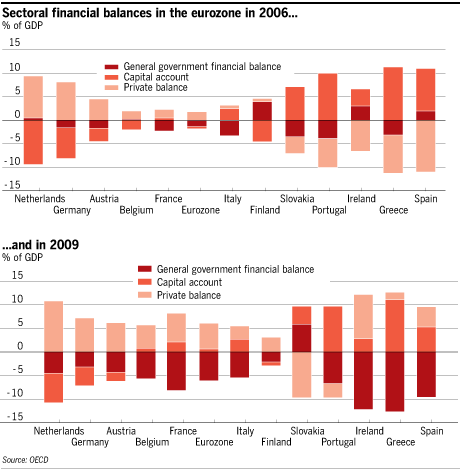

“The first thing to realize is that government deficits are balanced by imports and private savings. I’m talking here about the financial sector balances, of course.

The chart [below] from the FT shows you that the collective financial balances in each individual Eurozone country must sum to zero. Where there is a government surplus it is matched by either the capital account or private balances. The same is true for deficits.