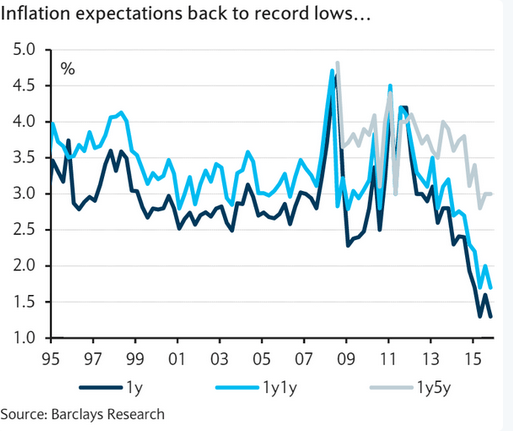

@SoberLook yesterday shared this chart of collapsing UK inflation expectations from Barclays Research UK, heightening fears of a deflationary spiral. As noted in an earlier blog, the year 2015 began with the Chancellor, George Osborne ‘welcoming’ the news that inflation had fallen in December to 0.5% – more than 1% below the official target. The FT declared that “this is almost certainly “good deflation”. Jittery stock markets are now skeptical of the Chancellor’s earlier complacency as UK prices continued to fall at the end of 2015, as the ONS chart below shows. This is worrying for firms, SMEs and households, as both debt and debt servicing costs rise in real terms as general falls in the prices of goods and services occur, and as average real wages remain almost 8% below pre-crisis level. (This is calculated from ONS data comparing Q1 2008 with Q3 2015).