By Jeremy Smith

Last week the European Commission published its Winter 2013 economic forecast, covering the expected outturn for 2012 as well as forecasts for the current year and 2014.

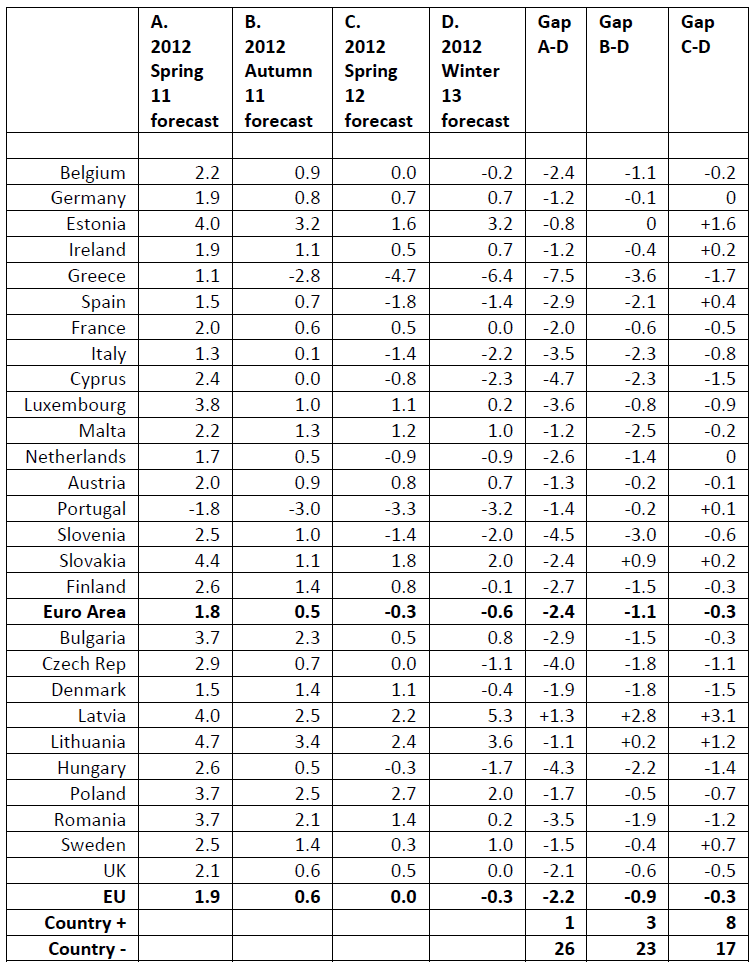

To assess the Commission’s accuracy in forecasting, we have looked at what it predicted, at different times, for 2012. We have taken its numbers for each country’s GDP, and the GDP for the Euro Area and EU, in its Spring 2011, Autumn 2011 and Spring 2012 forecasts. The table below sets out the detail.

In short, we find that its country predictions over-estimated GDP 66 times (81.48%), under-estimated it 12 times (14.81%), and got it right 3 times. Of the 12 under-estimates, 6 relate to the small Baltic states of Estonia, Latvia and Lithuania.

The Euro Area was over-estimated by 2.4%, 1.1% and 0.3% respectively in the three reports. EU GDP was over-estimated by 2.2%, 0.9% and 0.3% respectively.

The biggest error over the period relates to Greece where the difference between first estimate and latest projected outturn is a massive 7.5%!

Our point is not to criticize for not getting it spot-on all the time, but to show that there seems to be a systematic bias in its model in favour of predicting more ‘growth’ than was the case. In other words, the European Commission systematically convinced itself – and wants to convince others – that austerity policies would achieve rapid positive results. But they got it wrong each time through using a flawed analysis.

No wonder Commissioner Rehn is unhappy with the IMF for emphasizing the larger multiplier effect!

EU forecast table 2012

2 responses

I think you’re being awfully kind just saying the analysis is flawed. As if there was some unintentional error in the equation and they will say “Oh I didn’t notice, thanks for pointing that out” ….”There we go all corrected now”.

The motivation behind all these “flaws” is to increase the income and relative power of the Bourgeoise class. Primarily by increasing the profitability of financial institutions/ corporations and privatisation of public services. There was no mistake. The only mistake they made was making it too easy to find the flaws.

They are waging a war to increase profits and establish new streams of rentier income. Public commons are land they wish to conquer, democracy and organised labour are their enemies. As an average salaried employee I am a target with a large circle on my forehead, if I get shot it is deliberate…..not an accident or unfortunate collateral damage.

Stop acting as if these people are remotely interested in pursuing public purpose or the common good. They are utterly focussed on a one way street straight to their own bank accounts. Anyone in their path will be mown down.

I’m a layman, but as I understand the situation the economists looked at previous recessions and just assumed that all recessions are the same: a period of negative growth followed by a period of accelerated growth bringing the economy back to the long term trend of (shallow) exponential growth that was in place for 100 years or more. Thus is surely what history graduate George Osborne has done. Everyone keeps predicting a return to growth soon because that’s what recessions do (under any kind of political regime). Isn’t it?

Because they don’t consider levels of private debt, which are very much higher this time, they don’t see anything different about this recession. The rhetoric is all about sovereign debt but we know that Spain had lower sovereign debt than either Germany or Britain pre-2007 and it was trending downwards at the time. That single example ought to have blown the sovereign debt theory out of the water, but it didn’t. And because they conceive of the problem in terms of sovereign debt cutting spending was the *only* answer.

Almost no one seems to have looked at Japan and the 15 year recession they had – Richard koo’s analysis is insightful and not difficult to understand. Business and consumers (as aggregates) are busy minimising debt instead of maximising profit, or investing or spending. Thus growth is low and tax revenues are low. That won’t change in the short term.

It’s kind of bizarre to me that I can see the logic of this but professional economists can’t. I’m sure the situation is more complex than I understand, but that doesn’t invalidate the Spanish example. What went wrong in Spain if government debt was not the problem? UK debt is still only about 73% of GDP. That’s hardly a disaster – especially when consumer and business debt is so much higher! If we dealt with private debt we’d be in a much stronger position.

Unfortunately most of the Western world bought into the fantasy of the Long Boom (aka the Great Moderation or the End of Boom and Bust) when they were just surfing the expansion of a debt bubble of staggering proportions.

Actually I notice that private debt is starting to be mentioned in passing by some players. Merv King mentioned it recently. Osborne included it in a list of factors. Maybe there is hope? But what I imagine will happen is that we’ll go through another iteration or two of debt bubbles that wreck havoc and destroy lives before it starts to sink in.