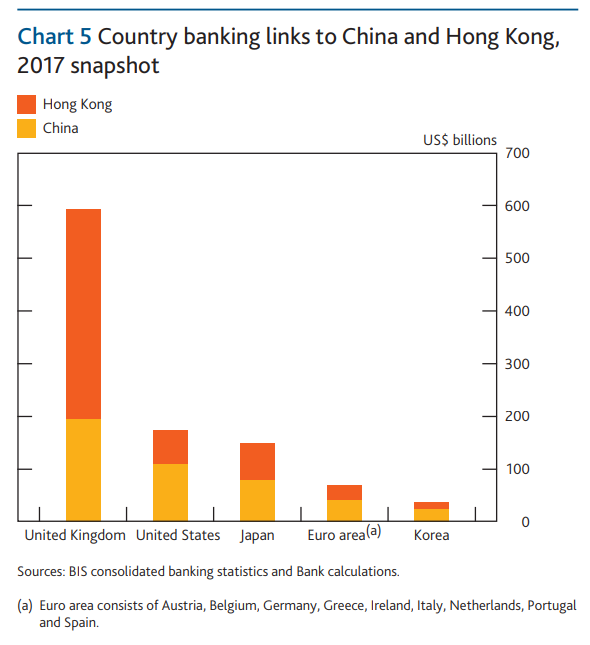

While the exposure to China is dwarfed by the UK exposure to Hong Kong, there is no discussion of the scale of indebtedness in Hong Kong. Presumably much of this is down to HSBC, to whom we also owe the hideous branding on UK airports.

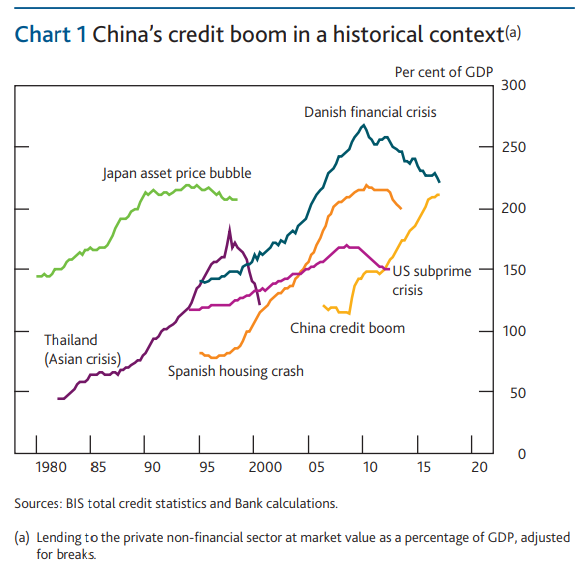

In the recent (27 June) Financial Stability Review, Chart 1 from the Quarterly Bulletin is reproduced (as chart A.28) – with the warning in the chart’s title, “Countries that underwent sharp credit booms have often experienced a crisis” (which is also cited at the top of this post). There is also a little more discussion around a relation between US monetary policy and the Hong Kong property market. The banking system is “well placed” to absorb shocks from this source (p. 23). Once again the wider danger to UK financial stability is recognised, though again without an assessment of Hong Kong private debt:

“A serious downturn in China and Hong Kong is likely to have a significant impact on UK financial stability through several channels. UK banks have significant assets in China and Hong Kong (representing nearly 200% of CET1) … In addition, UK banks also have large exposures to Japan, Korea, Singapore and Taiwan (over 140% of CET1), which have close trade links with China.”

On emerging market economies in general, the Bank is relative sanguine. There is an appeal to the authority of an analysis posted on the Federal Reserve website:

A study by the US Federal Reserve Board suggests that riskier corporate debt (where the earnings of the borrower are in danger of being insufficient to pay the interest on the debt) is a relatively low share of GDP in most EMEs outside China and would rise only moderately after an economic shock. (p. 14)

Arguably this analysis (‘How vulnerable are EME corporates?’ by Daniel O. Beltran and Christopher G. Collins) is somewhat overplayed. It is attributed to the Federal Reserve, but is posted on their website as an ‘IFDP note’ as follows:

“IFDP Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than IFDP Working Papers”.

The Beltran & Collins post includes the disclaimer:

“The views in this paper are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Board of Governors of the Federal Reserve System or any other person associated with the Federal Reserve System”.

The analysis is also selective, focusing on company account data for only 15 emerging market economies (see below).

In advanced economies the Bank’s preoccupation is with riskier lending and underwriting standards. They observe that US corporate debt as a share of income “is now similar to pre-crisis levels” (p. 16).

Moreover “underwriting standards have weakened” (p. 16). There are warnings around an increase in the share of “leveraged lending deals with weaker covenants — where investors accept fewer safeguards in the event of a deterioration in the debtor company’s finances — [which have] increased to over 80% in 2018, from less than 5% in 2010” (p. 17). And echoing pre-crisis behaviour,

“A large share of leveraged loans are packaged into securities sold as CLOs [collateralised loan obligations]” (p. 17).

New debt figures for the UK are constructed including ‘leveraged loan issuance’, some of which is thought not to be captured by official statistics. But overall, and perhaps a little ambiguously, “UK corporate leverage has not reached unusually high levels” (p. 17).

But the fear is that these relatively in-depth assessments are still selective and avoid the wood for the (admittedly big) trees.

My earlier analysis (Tily, 2018) offered a specific numerical threshold to capture the Bank’s idea of “sharp credit booms”. Looking at G7 economies, increases in private debt of more than 4 percentage points of GDP a year has been a good indicator of a coming reversal.

Certainly on this basis China is undergoing an extreme debt inflation – or debt hyper-inflation.

But notably private debt in Hong Kong is inflating even more quickly – in fact since 2008 the fastest in the world.

And there are many other countries in this position, not only emerging market countries but also advanced economies (various financialised countries, and strikingly Canada and France). And likewise some low-income developing economies. The table below summarises the position. [2] Note that only five of the fifteen countries in the ‘Fed’ analysis are in this table: Turkey, Thailand, Malaysia and China and Hong Kong.

The world is once more seriously leveraged. I think more than ever before – and the analysis here covers only private debt. Instability has returned to global financial markets. The Bank for International Settlements goes as far as saying “In a number of EMEs, the financial cycle appears to have already turned” (BIS, 2018, p. 16).

In common language that suggests coordination, it is hardly surprising that both the BoE and BIS describe risks as “material”: “risks from global vulnerabilities remain material and have increased” (BoE, 2018, p. 1); “[t]he conclusion is that medium-term risks are material” (BIS, 2018, p. xi).

[1] ‘Google Scholar’ shows a minimum of 9 citations of Fisher’s paper in 1987 and a maximum of 310 in 2014 (between 1986 to 2018).

[2] The ‘Fed’ analysis is based on country-level data for 13 countries, only five of which overlap with the list above (Turkey, Thailand, Malaysia and China and Hong Kong).