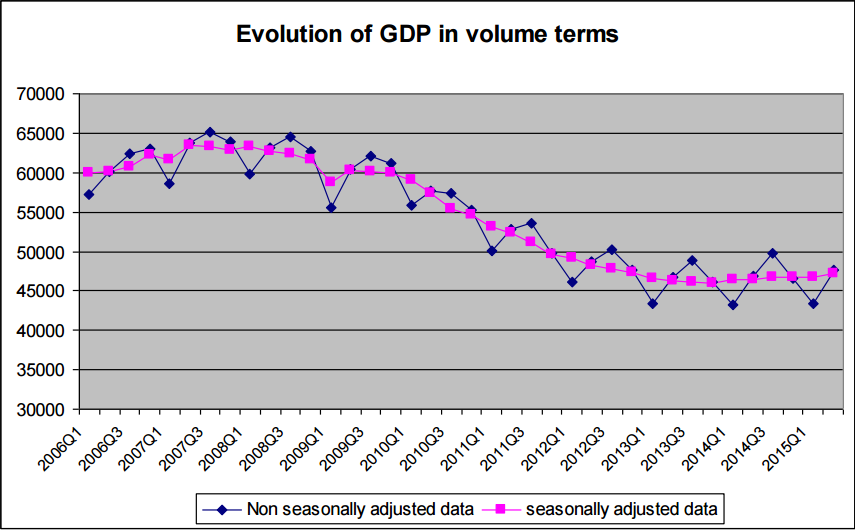

Thus, it appears that in real terms, the economy has plateaued since 2013, following a vertiginous fall since 2008. However, real GDP is still almost 27% below peak Q2 level of 2007, and 21% below Q2 of 2006.

What is more, nominal GDP has risen another 0.1%, following a 0.1% rise in Q1 – both Quarter on Quarter. This means that deflation has eased over the life of the Syriza government. In annual terms, nominal GDP also rose 0.1%, compared to a drop of 0.4% in Q1.

This marginal improvement still means that nominal GDP in Greece in Q2 is a massive 26% below the peak Q2 in 2008, and 18% below the 2006 level. This represents surely the biggest, most sustained fall in nominal GDP of any OECD country in recent decades, and indicates the extent of deflation

2nd quarter of 2015 the Gross Domestic Product (GDP) in volume terms increased by 0.9% compared with the 1st quarter of 2015 against the increase of 0.8% that was calculated for the flash estimate of the 2nd quarter, and was announced on August 13, 2015. In comparison with the 2nd quarter of 2014, it increased by 1.6% – best Q2 % y/y increase since 2007. Best GDP Q2 level since 2012.

Looking at the components of GDP, we see that the main increase is in “consumption” with household and government consumption increasing by 2.5% and 2.3% on Q2 2014 (with government expenditure rising 3.8% on Q1). Against this, investment (gross fixed capital formation) has fallen 3.3% year on year, whilst a big reduction in inventories meant that overall capital formation fell by over 15%.

Net trade made a small positive impact – both imports and exports fell year on year, but imports by a greater percentage, meaning that the trade balance slightly improved.