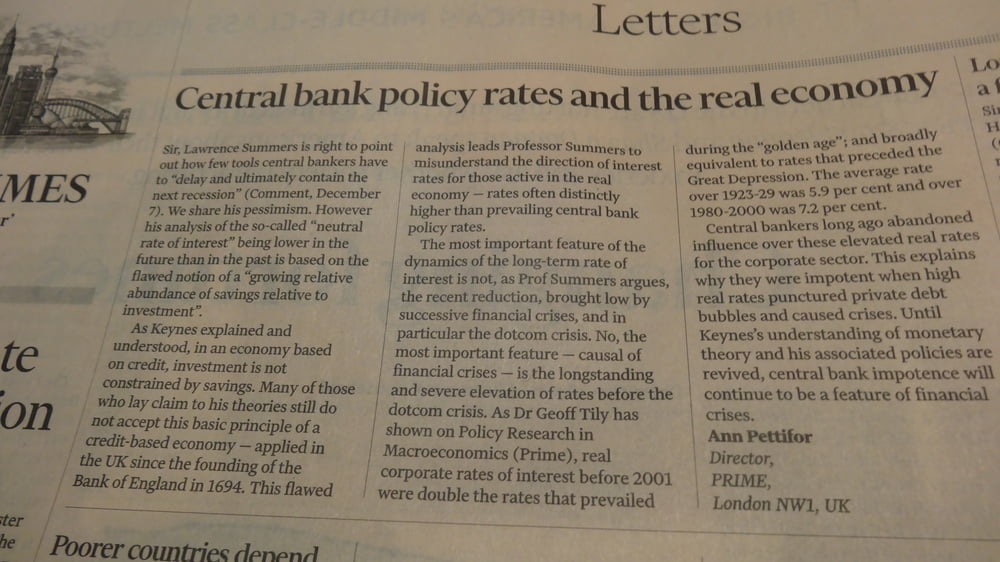

The following letter from PRIME’s Director Ann Pettifor was published in the paper edition of the Financial Times on Thursday (10 December, see image above), and online here on 9 December, in response to an oped in the FT from Larry Summers, “Central bankers do not have as many tools as they think”.

Dear Sir,

Sir, Lawrence Summers is right to point out how few tools central bankers have to “delay and ultimately contain the next recession” (Comment, December 7). We share his pessimism. However his analysis of the so-called “neutral rate of interest” being lower in the future than in the past is based on the flawed notion of a “growing relative abundance of savings relative to investment”.

As Keynes explained and understood, in an economy based on credit, investment is not constrained by savings. Many of those who lay claim to his theories still do not accept this basic principle of a credit-based economy — applied in the UK since the founding of the Bank of England in 1694. This flawed analysis leads Professor Summers to misunderstand the direction of interest rates for those active in the real economy — rates often distinctly higher than prevailing central bank policy rates.

The most important feature of the dynamics of the long-term rate of interest is not, as Prof Summers argues, the recent reduction, brought low by successive financial crises, and in particular the dotcom crisis. No, the most important feature — causal of financial crises — is the longstanding and severe elevation of rates before the dotcom crisis. As Dr Geoff Tily has shown on Policy Research in Macroeconomics (Prime), real corporate rates of interest before 2001 were double the rates that prevailed during the “golden age”; and broadly equivalent to rates that preceded the Great Depression. The average rate over 1923-29 was 5.9 per cent and over 1980-2000 was 7.2 per cent.

Central bankers long ago abandoned influence over these elevated real rates for the corporate sector. This explains why they were impotent when high real rates punctured private debt bubbles and caused crises. Until Keynes’s understanding of monetary theory and his associated policies are revived, central bank impotence will continue to be a feature of financial crises.

Yours sincerely,

Ann Pettifor

One Response

Monetary policy: no sound theoretical foundation

Comment on Ann Pettifor on ‘Central bank policy rates and the real economy’

That Lawrence Summer’s theory of the “neutral rate of interest” cannot be taken seriously goes without saying. The crux of the matter is that the Keynesian alternative is not much better.

After-Keynesians have not realized until this very day that Keynes had messed up the formal foundations of the General Theory which is given with this two-liner “Income = value of output = consumption + investment. Saving = income – consumption. Therefore saving = investment.” (1973, p. 63)

The fatal flaw of Keynesianism is that the underlying profit theory is false (2011). And it should be beyond any doubt that if one gets the pivotal concept of economics wrong all the rest of one’s theory is vacuous. From this follows that Keynesian policy proposals have no sound theoretical foundation — just like neoclassical policy advice.

A recent discussion of the theory of interest on David Glasner’s blog Uneasy Money focused on these issues: Keynes and Accounting Identities, Keynes on the Theory of Interest, The Well-Defined, but Nearly Useless, Natural Rate of Interest, Thinking about Interest and Irving Fisher. For my posts see:

Keynes and the logical brilliance of Bedlam

http://axecorg.blogspot.de/2015/10/keynes-and-logical-brilliance-of-bedlam.html

End of confusion

http://axecorg.blogspot.de/2015/10/end-of-confusion.html

Interest and profit

http://axecorg.blogspot.de/2015/10/interest-and-profit.html

Accounting basics

http://axecorg.blogspot.de/2015/10/accounting-basics.html

Humpty Dumpty is back again

http://axecorg.blogspot.de/2015/11/humpty-dumpty-is-back-again.html

Down and out

http://axecorg.blogspot.de/2015/11/down-and-out.html

Are economists methodological retards?

http://axecorg.blogspot.de/2015/11/are-economists-methodological-retards.html

Debunking the natural rate of interest

http://axecorg.blogspot.de/2015/11/debunking-natural-rate-of-interest.html

How economic thinkers think they think about interest

http://axecorg.blogspot.de/2015/11/how-economic-thinkers-think-they-think.html

The Fisher Effect — a specimen of scientific incompetence

http://axecorg.blogspot.de/2015/12/the-fisher-effect-specimen-of.html

You conclude: “Until Keynes’s understanding of monetary theory and his associated policies are revived, central bank impotence will continue to be a feature of financial crises.”

There is absolutely no need to revive a logically and materially inconsistent approach. This cannot cure central bank impotence which is the very consequence of the scientific incompetence of economists of all stripes.

Egmont Kakarot-Handtke

References

Kakarot-Handtke, E. (2011). Why Post Keynesianism is Not Yet a Science. SSRN

Working Paper Series, 1966438: 1–20. URL http://ssrn.com/abstract=1966438.

Keynes, J. M. (1973). The General Theory of Employment Interest and Money.

The Collected Writings of John Maynard Keynes Vol. VII. London, Basingstoke:

Macmillan.