This article by T. Sabri Öncü first appeared in the Indian journal the Economic and Political Weekly on 9 March 2017.

A Partial Jubilee Financed by Zero Coupon Perpetual Bonds

There have been two main proposals to tackle the stressed asset problem of the Indian banks since the beginning of this year. Both proposals are based implicitly on the financial intermediation theory of banking. The alternative credit creation theory of banking opens up other possibilities. One such possibility is a partial Jubilee financed by zero coupon perpetual bonds.

I closed the November 2016 H T Parekh Column article (Öncü 2016) as follows: “A global Jubilee is in order.”

This was my proposal to tackle the difficulty of resolving the “private debt overhang” problem in the current global environment of low nominal output growth. The International Monetary Fund (IMF) issued a warning in the title of its October 2016 Fiscal Monitor: “Debt—Use It Wisely” (IMF 2016).

In this article, I propose that India lead the world.

What is Jubilee?

Jubilee comes from Judaic Law (Leviticus 25). It is a clean slate to be proclaimed every 49 years (seven Sabbath years—Sabbath means to cease, to end or to rest) annulling personal and agrarian debts, liberating bond-servants to rejoin their families, and returning lands that had been alienated under economic duress (Hudson 2013).

Jubilee is not a religious fiction or ideal as some think it is. It has been traced back to royal proclamations issued in Sumer and Babylonia in the third and second millennia BC. It used to happen quite often, and debt write-offs happen quite regularly even these days (Öncü 2016).

What are Zero Coupon Perpetual Bonds?

The oldest known perpetual bond in the world that still pays coupon (at an interest rate of 2.5%) was issued in 1624. It was originally floated to raise funds for the repair of a dike by the Hoogheemraadschap Lekdijk Bovendams, a Dutch water authority responsible for maintaining levees (Andrews 2016). As the name suggests, a perpetual bond never pays principal. It pays coupons with some stated frequency on the stated principal (the face value or the price it was issued) only.

But, what if a perpetual bond does not pay any coupon either? At what price would such a bond sell other than zero? How much would it cost to issue the bond to its issuer other than almost nothing?

As crazy as the zero coupon perpetual bond idea may sound, the banknotes we carry in our wallets are essentially zero coupon perpetual bonds. They pay neither coupon nor principal. Yet, they have face values written on them such as ₹100 or ₹500. And, they buy things at their face value.

The most recent zero coupon perpetual bond proposal belongs to the former chairman of the Federal Reserve Bank of the United States (US), Benjamin Bernanke, and earned him the nickname “Helicopter Ben”. In July 2016, Bernanke proposed to “Japan that helicopter money—in which the government issues non-marketable perpetual bonds with no maturity date and the Bank of Japan directly buys them—could work as the strongest tool to overcome deflation” (Fujiko and Ujikane 2016).

I will propose zero coupon perpetual bonds to India also. But, not in the way Bernanke proposed them to Japan.

Non-performing Assets in India

The non-performing assets (NPAs) of the Indian banking sector has been on the rise since September 2008, with faster deterioration after September 2009. Interestingly, while the private sector banks were suffering from most of the NPAs in September 2008, after September 2009 the public sector banks have started to take the lead and, now, the public sector banks are suffering from most of the NPAs (Unnikrishnan and Kadam 2016).

The deterioration that started in September 2008 continued until the last quarter ending 31 December 2016, and NPAs reached 9.3% of the total credit extended by the entire (public and private) banking system, while NPAs of public sector banks were 11% of the total credit they extended. What is worse is that five of the public sector banks had NPAs of above 15%. The size of the NPAs of the entire banking system at the end of this quarter was ₹6.7 trillion and 88.2% of this amount was on the books of the public sector banks (Mathew 2017).

As noted by Chandrasekhar (2017), the Indian Ministry of Finance’s Economic Survey 2016-17 recognised that under normal circumstances this would have threatened the banks concerned with insolvency, perhaps triggered a bank run, forced bank closure and even precipitated a systemic crisis. Chandrasekhar (2017) also noted that according to the Survey, since there is belief that these banks have the backing of the government, which will keep them afloat, the bad loan problem has not, as yet, become a systemic crisis.

Whether the bad loan problem in India has become a systemic crisis or not can be debated. However, that India needs to decisively resolve her banks’ stressed (nonperforming, restructured or written-off) assets with a sense of urgency the newly appointed Reserve Bank of India (RBI) Deputy Governor Viral Acharya mentioned in his 22 February 2017 speech cannot be.

Proposals on the Table

A “bad bank” is a corporation established to isolate stressed assets held by a bank or financial institution, or a group of banks or financial institutions. It might be established privately by the bank or financial institution, or the group of banks or financial institutions, or by the government or some other official institution.

There have been two main proposals to tackle the stressed asset problem of the Indian banks since the beginning of this year. The first one was the “bad bank” proposal made in the Survey:

“NPAs keep growing, while credit and investment keep falling. Perhaps it is time to consider a different approach—a centralised Public Sector Asset Rehabilitation Agency [PARA] that could take charge of the largest, most difficult cases, and make politically tough decisions to reduce debt.”

The PARA to resolve the stressed assets of the public sector banks is the “bad bank” the Finance Ministry proposed. The Survey gives a detailed description of how the PARA would work and mentions that the funding for PARA would come from three sources: (i) the government issued securities; (ii) the capital market and (iii) the RBI. The first two of these sources are not unusual. However, the third source is rather unusual (although not novel as the Survey documents):

“The RBI would (in effect) transfer some of the government securities it is currently holding to public sector banks and PARA. As a result, the RBI’s capital would decrease, while that of the banks and PARA would increase. There would be no implications for monetary policy, since no new money would be created.”

The second proposal came from the RBI Deputy Governor Viral Acharya on 22 February 2017. Although rumour has it that he was hired for his advocacy of “bad banks”, Acharya clarified that his suggestion is not akin to creating a “bad bank”, but is more to create a resolution agency. He suggested two models. A Private Asset Management Company (PAMC) and a National Asset Management Company (NAMC).

Under the PAMC, banks would come together to approve a resolution plan based on proposals from a variety of different restructuring agencies and vetted by rating agencies. As he explained, there

“are ways to arrange and concentrate the management of these assets into a single or few private asset management companies (PAMCs), at the outset or right after restructuring plans are approved. These companies would resemble a large private-equity fund run by a team of professional asset managers. Besides bringing in their own capital, they could raise financing from investors against equity stakes in individual assets or in the fund as a whole, i.e., in the portfolio of assets” (Mathew and Dugal 2017).

As Acharya argued, the PAMC would be more suitable for sectors such as steel and textiles where some sectoral recovery is in sight whereas the NAMC—in which the government would play a larger role—would be more appropriate for infrastructure investments such as power where the assets may appear to be unviable in the short to medium term. However, even the NAMC would bring in asset managers such as Asset Reconstruction Companies (ARCs) and private equity to manage and turn around the assets, individually or as a portfolio, although the government may retain a minority stake in the assets.

To sum up, while the Finance Ministry proposed a mainly public solution, Acharya proposed mainly private or market solutions to the problems.

My Criticism of the Proposals

Although given the urgency of the situation both proposals have many merits, many have attacked both of the proposals for a multitude of theoretical and ideological reasons. This is normal of course because economics is not even the “dismal” science as some call it. What is wrongly called economics these days used to be correctly called political economy as the following title from the 27 February 2017, Times of India demonstrates (Sidhartha 2017): “Few Supporters in Govt for ‘Bad Bank’ Proposal.”

Here is a quotation from this article.

“Sources in the finance ministry, however, said that the issue is best left to banks as the government did not have the required resources to meet the capitalisation needs. In addition, it does not want to be seen bailing out companies and banks when the same resources can be deployed elsewhere.”

The above is what I mean when I say there is no economics but political economy. Under these conditions, it would be unfair to criticise either of the proposals, but I have to criticise both on one account.

It is that both of the proposals operate under the implicit assumption that “banks are financial intermediaries”.

The problem is that banks are not financial intermediaries. They are money creators. Banks create money either by extending credit or by buying government securities while in the process creating the corresponding deposits. In other words, banks do not collect or mobilise deposits to lend them out. Although banks can collect deposits from each other, when we look at the entire banking system as a single bank, there is no other place from which this bank can collect deposits except the holders of currency in circulation. That is, the banking system does not collect or mobilise deposits first and then extend credit or buy government securities. It is the other way around.

Lost Century in Economics

In an article titled “A lost century in economics: Three theories of banking and the conclusive evidence”, Werner (2016) argues the following.

“During the past century, three different theories of banking were dominant at different times: (1) The currently prevalent financial intermediation theory of banking says that banks collect deposits and then lend these out, just like other non-bank financial intermediaries. (2) The older fractional reserve theory of banking says that each individual bank is a financial intermediary without the power to create money, but the banking system collectively is able to create money through the process of ‘multiple deposit expansion’ (the ‘money multiplier’). (3)

The credit creation theory of banking, predominant a century ago, does not consider banks as financial intermediaries that gather deposits to lend out, but instead argues that each individual bank creates credit and money newly when granting a bank loan. The theories differ in their accounting treatment of bank lending as well as in their policy implications. Since according to the dominant financial intermediation theory banks are virtually identical with other non-bank financial intermediaries, they are not usually included in the economic models used in economics or by central bankers. Moreover, the theory of banks as intermediaries provides the rationale for capital adequacy-based bank regulation. Should this theory not be correct, currently prevailing economics modelling and policy-making would be without empirical foundation”. (Emphasis added)

In a working paper by the Bank of England titled “Banks are not intermediaries of loanable funds—and why this matters,” Jakab and Kumhof (2015) describe the money creation process as follows.

“In the intermediation of loanable funds model of banking, banks accept deposits of pre-existing real resources from savers and then lend them to borrowers. In the real world, banks provide financing through money creation. That is, they create deposits of new money through lending, and in doing so are mainly constrained by profitability and solvency considerations.”

In this paper, Jakab and Kumhof quoted Alan Holmes (1969), a former vice president of the New York Federal Reserve, who wrote the following: “In the real world, banks extend credit, creating deposits in the process, and look for the reserves later.”

How is Money Created in India?

In 1969, Holmes was talking about the US. The situation is somewhat more complicated in India because there have been two liquidity requirements imposed on the banks by the RBI after the independence. These two requirements are called the cash reserve ratio (CRR) and the statutory liquidity ratio (SLR).

Prior to further progress, let me clarify what the RBI means by “cash”.

In the language of the RBI, “cash” does not mean just the rupee banknotes, and the rupee and smaller coins. Beyond these three are the “bank deposits” with the RBI which are just some numbers on some computers these days. So, rather than “cash” and consistent with the rest of the world, I will use the word “reserves” for these “bank deposits” with the RBI and save the word “cash” to mean what we ordinary people think “cash” is in our daily lives. The economists call the sum of cash and reserves, base money, whereas the sum of cash and deposits is broad money. It should be mentioned that while cash and deposits can buy things in the real world, reserves cannot. Reserves are common currency only among the banks and the RBI, and cannot go out of the banking system.

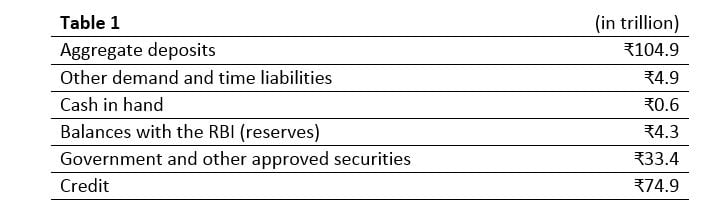

To sum up, the CRR is what the most of the rest of the world calls the “required reserve ratio”. As Holmes (1969) described for the US, the banks first create deposits by extending credit or buying government securities and then look for reserves to meet the CRR requirement also in India. The most recent banking data available at the RBI website—as of 17 February 2017 at the time of writing—shows that the reserve to deposit ratio was about 4%, which is consistent with the current CRR requirement.

And, had the CRR been the only liquidity requirement, the money creation process in India would have been no different than the money creation process in the US, for example. What sets India apart from most other countries is the SLR requirement. Because, the SLR requirement can be met not only by holding “reserves”, but also by holding gold and “government approved securities”.

When we look at the SLR historically, we see that the commercial banks in India have met their SLR requirement by holding “government approved securities” mostly. In addition, if we look at the above mentioned RBI data we see also that way above 99% of the “government approved securities” were “government securities”. This comes as no surprise because these securities are very safe and pay high interest rates.

Further, as of the same date, the credit to deposit ratio was roughly about 70% while the government approved securities to deposit ratio was roughly about 30% and these two ratios nearly added up to 100% despite the expected measurement errors. Given that the current SLR requirement is 20.5%, this indicates also that the banks are holding way more government securities than they are required. This is understandable, because the banks need non-SRL government securities to repo (see, for example, Acharya and Öncü 2010 for a description) with the RBI to obtain reserves to meet their CRR requirement.

To sum up, while the CRR is a tool of the RBI to manage the liquidity in the banking system, the SRL is a tool to manage the liquidity in the economy, although nowadays the RBI uses the CRR to manage the liquidity in the economy also. To clarify these further, let me summarise the 17 February 2017 data from the above mentioned RBI website.