By Cem Oyvat, T Sabri Öncü and Joel Rabinovich

A slightly edited version of this article first appeared in the Indian journal, Economic & Political Weekly, on 15 February 2025.

Cem Oyvat ([email protected]) teaches economics at the University of Greenwich. T. Sabri Öncü ([email protected]) is an independent economist based in İstanbul. Joel Rabinovich ([email protected]) teaches international political economy at King’s College London.

Introduction

Argentina’s political and economic landscape has oscillated between neoliberalism and neodevelopmentalism over the past two decades, each model failing to deliver sustained prosperity (Öncü, 2024). After the 2001 economic crisis under neoliberal policies, the country shifted to neodevelopmentalism under Néstor and Cristina Fernández de Kirchner. This approach emphasised state intervention, social inclusion, and capital controls, aiming to foster economic growth and reduce inequality. Argentina experienced significant economic growth during the earlier years of the Kirchner governments, achieving average annual growth rates of 8.8% between 2002 and 2007 and 6.3% between 2002 and 2011, driven by neodevelopmentalist policies. However, the model’s inability to address structural challenges, coupled with external shocks, led to its eventual decline.

The return to neoliberalism under Mauricio Macri in 2015 brought hopes of stability through deregulation, austerity, and market-oriented reforms. Yet, these policies resulted in economic instability, soaring inflation, and a debt crisis, culminating in a $57 billion IMF bailout in 2018. By the end of Macri’s term, Argentina was in recession, with a cumulative inflation at 240% and poverty rates rising sharply. The subsequent return to neodevelopmentalism under Alberto Fernández in 2019 offered initial optimism, but internal political divisions, the COVID-19 pandemic, and a severe drought in 2023 exacerbated economic stagnation and inflation. The government’s inability to address these challenges led to widespread disillusionment, paving the way for Javier Milei, a libertarian far-right economist, to win the 2023 presidential election.

Milei’s rise reflects a rejection of both neodevelopmentalism and traditional neoliberalism, as voters sought radical change amid deepening economic crises. This article examines the economic and social impacts of Milei’s policies, focusing on their short-term outcomes and long-term sustainability to provide a comprehensive assessment of Argentina’s current economic trajectory.

Milei’s Shock Therapy Agenda

Following the election of Milei in December 2023, Argentina adopted a “shock therapy” approach to economic policy, centred on austerity measures, the shrinkage of the state, and the removal of price controls. These policies led to significant reductions in public sector employment, wages, pensions, and government expenditures across various sectors.

Public Sector Cuts and Austerity Measures

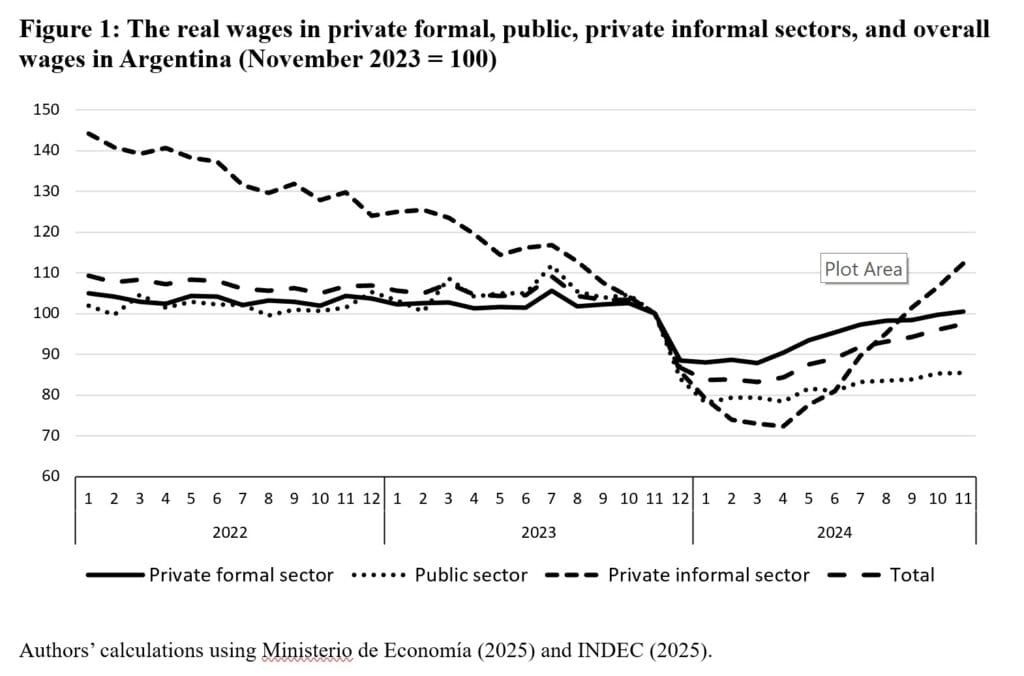

Between November 2023 and September 2024, 38,600 jobs were eliminated in the public sector, reducing public employment from 3,492,267 to 3,453,658 positions—a 1.1% decline over ten months [1]. Public sector wages and pensions also fell significantly in real terms, as increases were kept well below inflation. Between November 2023 and November 2024, public sector wages dropped by 14.5% in real terms (Figure 1), while expenditures on pensions were slashed by 16.4% for contributory schemes and 13.9% for non-contributory schemes (Table 1).

Public infrastructure projects faced severe cuts, with the central government’s capital expenditures reduced by 77.2% in 2024 after adjusting for inflation (Table 1). Subsidies for provincial governments and the Buenos Aires Metropolitan Area (AMBA) were also reduced, leading to a sharp rise in transport costs. For example, the cost of a ride on the Buenos Aires metro increased by 360% overnight in May 2024, jumping from 125 pesos to 574 pesos. [2]

Energy subsidies, which had kept prices 15% lower before Milei’s presidency, were significantly reduced. Transfers to provinces from the central government declined by 67.8% (Table 1), placing additional financial strain on regional administrations. Public transfers to universities fell by 25.5% in real terms in 2024, while public expenditures on research were cut by 31%. Argentina’s primary science agency, the National Council of Scientific and Technical Research, lost approximately 1,000 employees—around 9% of its workforce—within less than a year of Milei taking office [3]. These cuts have triggered a growing brain drain as researchers and academics seek opportunities abroad amid deteriorating conditions.

Fiscal Tightening and Budget Surplus

As a result of Milei’s austerity policies, central government expenditures declined by 27.5% between 2023 and 2024 (Table 1). However, both tax and total revenues also fell by 2.7% and 5.6%, respectively, in 2024 [4]. Despite this, the budget achieved a surplus of 1.76 trillion pesos (0.3% of GDP) for the first time in 14 years.

The surplus was driven largely by drastic reductions in pensions and capital expenditures, which accounted for 20.8% and 23.7% of the overall decline in central government expenditures, respectively (Table 1). Social benefits, including pensions, contributed significantly to the reduction in public spending, making up 32.6% of the total decline. Other major contributors included real-term reductions in public sector salaries, subsidies for energy and transportation, and transfers to provincial governments.

Inflation and Price Controls

On the second day of Milei’s presidency, the Argentine peso was devalued by 54%, and price controls on essential food products and medicines were removed. The expiration of price control agreements, signed by former economy minister Sergio Massa, led to significant price increases for certain food products. By December 2024, medication prices had surged by approximately 40%, resulting in a 45.8% decline in pharmaceutical sales in January 2024 compared to January 2023 [5].

(Authors’ calculations using Ministerio de Economía (2025) and INDEC (2025). The monthly statistics for central government expenditures are adjusted for CPI. https://www.economia.gob.ar/onp/ejecucion/2024)

Consumer prices rose by 71.4% in the first three months of Milei’s presidency (November 2023 to February 2024). The cost of food and non-alcoholic beverages increased by 74.7%, healthcare prices surged by 81.4%, and transportation costs soared by 102.2%. The annual inflation rate peaked at 289.4% in April 2024, up from 160.9% in November 2023.

Capital Controls and Exchange Rate Policies

Although Milei plans to remove the capital controls within the next few years, Argentina still maintains financial and capital account controls, as well as a crawling peg—policies inherited from the pre-Milei era. In February 2025, the Central Bank of the Argentine Republic (BCRA) slowed the monthly devaluation of the official peso rate against the US dollar from 2% to 1%, responding to declining inflation. However, as of the writing of this article, the black market rate for the US dollar remained approximately 15% higher than the official rate.

Strict capital controls remain in place, including a $200 monthly limit on US dollar purchases by individuals, additional taxes on dollar purchases, and restrictions on the use of local credit cards abroad. Exporters earning foreign currency are required to repatriate 100% of their earnings within a specified period, and foreign companies operating in Argentina must obtain central bank approval to transfer profits or dividends abroad. These measures have helped prevent the peso-to-dollar exchange rate from rising as sharply as consumer prices in the short term, contributing to the decline in monthly inflation.

Outcomes of Milei’s Shock Therapy

In this section, we analyse the economic and social outcomes of President Milei’s “shock therapy” policies, focusing on inflation, GDP contraction, unemployment, public services, wages and poverty. These measures, while achieving some short-term stabilisation (or a perception of it), have come at significant social and economic costs, raising questions about their long-term sustainability.

Inflation and Exchange Rate Dynamics

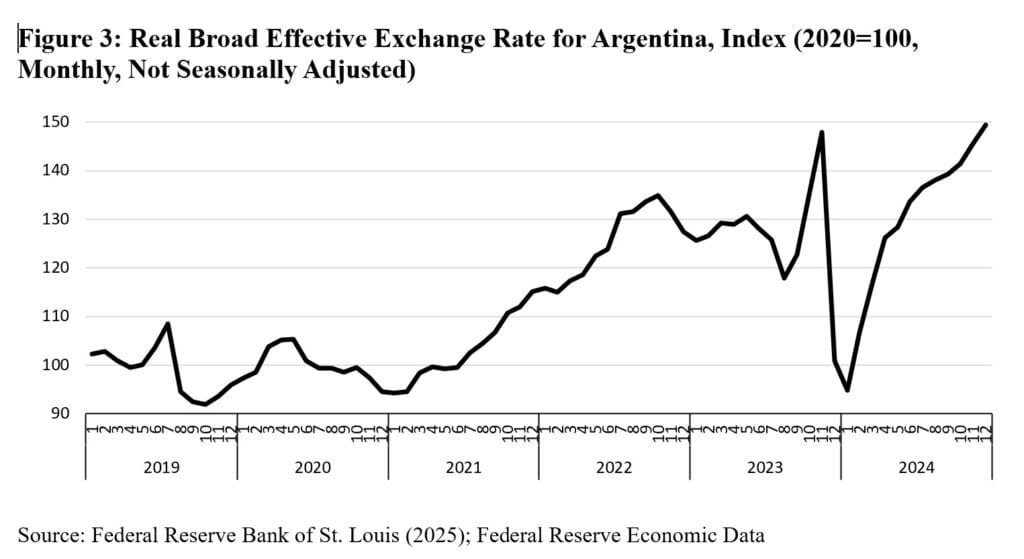

The annual inflation rate, which peaked at 289.4% in April 2024, began to decline, reaching 117.8% by December 2024 (Figure 2). By the end of the year, the monthly inflation rate stood at 2.7%. This decline was partly driven by a relatively modest 27% increase in the peso-to-USD exchange rate, which played a significant role in stabilising prices and also prevented further suppression of real wages. Empirical studies by Vernengo and Perry (2018), as well as de la Vega et al. (2024), have shown that the exchange rate is a primary driver of inflation in Argentina, with a far greater influence than output [6]. However, despite this progress, Argentina’s annual inflation remains among the highest in the world, and the country is far from declaring victory in its fight against inflation.

Economic Contraction and Rising Unemployment

Meanwhile, Argentina’s economy experienced a significant slowdown in 2024. Real GDP for the first three quarters of the year was 3.0% lower compared to the same period in 2023, and the IMF projects a 3.5% contraction for the full year [7]. Unemployment also rose, increasing from 5.7% in Q3 2023 to 6.9% in Q3 2024. Women were disproportionately affected, with their unemployment rate increasing from 6.3% to 7.9%, compared to a rise from 5.3% to 6.2% for men, exacerbating gender inequalities. Additionally, the share of self-employed workers in total employment grew from 21.6% to 23.3% during this period, reflecting the expansion of informal employment—a trend linked to the shrinking public sector.

Public Services and Infrastructure

Milei’s austerity measures have severely impacted public services. Real value added in public education and public social and health services declined by 18.1% and 19.5%, respectively, between Q3 2023 and Q3 2024. Public physical infrastructure expenditures fell by 77.1%, a sharp cut that is likely to have long-term negative effects on Argentina’s GDP growth and labour productivity. Reduced investment in both physical and social infrastructure is expected to hinder economic growth, increase unit labour costs, and undermine Argentina’s competitiveness. A policy framework that disregards the importance of infrastructure investment is unlikely to result in sustainable economic development.

Declining Wages and Rising Poverty

During Milei’s first year in office (between November 2023 and November 2024), real wages declined by 2.6%, driven by a 14.5% reduction in public sector wages. While private sector wages (both formal and informal) recovered to their 2023 levels, the share of employee compensation in gross value added fell from 44.9% to 43.2% between Q3 2023 and Q3 2024, reflecting a redistribution of income at the expense of the working class. According to the latest data from Argentina’s national statistical institute (INDEC), the poverty rate increased from 42.5% in the second half of 2023 to 52.9% in the first half of 2024.

Risks to Inflation Sustainability and Competitiveness

The sustainability of the inflation decline remains uncertain. The real exchange rate appreciated by over 40% (Figure 3)—more than in any other large emerging market—raising the risk of devaluation. Capital controls and a tax amnesty that encouraged dollar inflows have so far prevented a devaluation. Indeed, Argentina still achieved a current account surplus in Q3 2024 and a merchandise trade surplus in December 2024 with the support of suppressed aggregate demand. However, the peso’s overvaluation poses a significant risk, particularly if the economy experiences positive growth in 2025. As noted by the Financial Times, the appreciated peso has already negatively impacted tourism inflows while prompting more Argentines to travel abroad, as the country has become increasingly expensive for foreign tourists. [8]

Milei’s Intensified Push for Dollarisation

President Javier Milei has recently intensified his push to dollarise Argentina’s economy. Starting in late February 2025, debit card transactions in US dollars will be permitted. Milei describes this move as enabling Argentines to “buy, sell, and invoice in dollars, or in the currency they consider most convenient—except for the payment of taxes.” [9] This follows his campaign promise to shut down the Central Bank of the Argentine Republic and replace the peso with the US dollar as legal tender.

However, dollarisation poses significant risks. Replacing the peso with the dollar would strip Argentina of its monetary policy sovereignty, limiting its ability to respond to macroeconomic shocks. This loss of autonomy could exacerbate economic vulnerabilities during crises. By adopting the US dollar, Argentina would effectively outsource its monetary policy to the US Federal Reserve, whose priorities may not align with Argentina’s economic needs. This misalignment could worsen inequalities, stifle growth, and leave the country ill-equipped to address domestic economic challenges.

The transition would also require substantial fiscal tightening, as Argentina lacks sufficient dollar reserves to remove pesos from circulation. Even with austerity measures, the scale of the required reserves makes full dollarisation unrealistic for a government burdened with significant liabilities. [10]

Moreover, the loss of monetary sovereignty could harm Argentina’s competitiveness, particularly in its export sector. Without the ability to devalue its currency, Argentina’s exports could become less competitive globally. The Eurozone crisis offers a cautionary example: countries like Greece and Spain, unable to devalue their currencies or implement independent monetary policies, suffered prolonged economic downturns and soaring unemployment. For Argentina, dollarisation could similarly stifle growth and deepen dependence on external financial markets, offering short-term stability at the cost of long-term resilience.

Conclusion

Javier Milei’s shock therapy policies have garnered significant praise from liberals and libertarians worldwide, who claim his radical approach is a necessary break from Argentina’s history of economic mismanagement. However, his policies have inflicted severe social and economic costs on Argentina, undermining any short-term gains. While his administration has achieved a budget surplus and reduced inflation, these outcomes have come at the expense of public sector employment, wages, retirement benefits and essential services. Cuts to infrastructure, education, and research funding threaten long-term growth, while rising poverty and unemployment highlight the human toll of his austerity measures, with the retirees impacted the worst.

Moreover, Milei’s push for dollarisation risks eroding Argentina’s economic sovereignty, leaving the country vulnerable to external shocks and limiting its ability to implement independent monetary policies. The overvaluation of the peso further exacerbates these risks, threatening competitiveness and long-term stability. Far from offering a sustainable solution, Milei’s policies represent a dangerous gamble with Argentina’s future, prioritising short-term targets over the well-being of its people.

The case of Milei’s Argentina should also raise questions for orthodox economists who advocate neoliberal agendas with significant austerity measures. An austerity plan involving substantial cuts to public investments in physical infrastructure, education, and healthcare is likely to have severe negative consequences for long-term productivity growth. Even if it achieves minor short-term success in controlling inflation, such a strategy is unlikely to steer Argentina away from the sluggish and unstable growth trajectory it has endured for over a century.

References

Barberia, Lorena G. and Jorge Geffner (2024): “The health risks of extreme neoliberal politics in Argentina,” Nature Medicine, Vol 30, No.5, 1229-1230.

Öncü, T. Sabri (2024): “From Chile in 1973 to Argentina and Türkiye in 2023: Economic Genocide Continues,” Economic & Political Weekly, Vol. 59, No. 19, 10-13.

de la Vega, Pablo, Guido Zack, Jimena Calvo, and Emiliano Libman (2024): “Determinantes de la inflación en Argentina, 2004-2022,” Banco Central de la República Argentina, Ensayos Económicos, No. 83.

Vernengo, Matias and Nathan Perry (2018): “Exchange rate depreciation, wage resistance and inflation in Argentina (1882–2009),” Economic Notes: Review of Banking, Finance and Monetary Economics, Vol. 47, No. 1, 125-144.

Footnotes

[1] Centro de Investigación, Desarrollo e Innovación para el Sector Público (CIDISP) (2025). Empleo y salarios en el sector público. Diciembre de 2024. Universidad Nacional de San Martín.

[2] https://www.theguardian.com/world/article/2024/may/17/buenos-aires-metro-fare-increase

[3] De los Ángeles Orfila (2024). ‘Scienticide’: Argentina’s science workforce shrinks as government pursues austerity. Science. Science Insider. https://www.science.org/content/article/scienticide-argentina-s-science-workforce-shrinks-government-pursues-austerity

[4]Authors’ calculations using Ministerio de Economía (2025) and INDEC (2025).

[5]Barberia & Geffner (2024).

[6]Vernengo and Perry (2018) estimate that inflation is the primary cause of the inflation and output gap’s effect on inflation is ambiguous. In their Central Bank of the Argentine Republic working paper, de la Vega et al. (2024) find that exchange rate shocks explain 25 to 56% of inflation in different models. They estimate that changes in economic activity levels have little explanatory power over inflation dynamics.

[7] IMF (2025): Datamapper.

[8] https://www.ft.com/content/d3f831a7-e442-4e43-a8dd-e9d687a133cd

[9] https://www.batimes.com.ar/news/economy/argentina-takes-steps-to-speed-up-mileis-dollarisation-strategy.phtml

[10] https://www.economicsobservatory.com/how-would-dollarisation-affect-argentinas-competitiveness