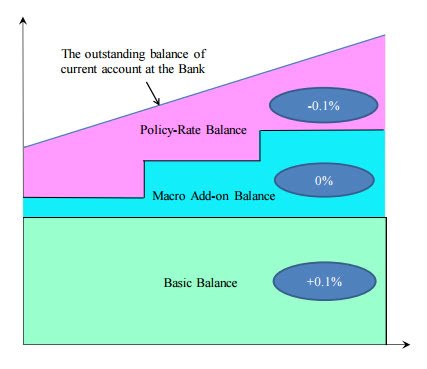

The bottom tier is a “basic balance” which is the existing reserve level in the banking system:

The average outstanding balance of current account, which each financial institution held during benchmark reserve maintenance periods from January 2015 to December 2015, corresponds to the existing balance and will be regarded as the basic balance to which a positive interest rate of 0.1 percent will be applied.

So existing reserves will (overall) continue to bear positive interest. Even banks that hold more than their benchmark level may avoid the negative rate, since the Bank of Japan has allowed for a reserve buffer at a zero interest rate:

A zero interest rate will be applied to the sum of the following amounts outstanding.

a) The amount outstanding of the required reserves held by financial institutions subject to the Reserve Requirement System

b) The amount outstanding of the Bank’s provision of credit through the Loan Support Program and the Funds-Supplying Operation to Support Financial Institutions in Disaster Areas affected by the Great East Japan Earthquake for financial institutions that are using these programs

c) The balance calculated as a certain ratio of the amount outstanding of its basic balance in (1) (macro add-on).

The calculation will be made at an appropriate timing, taking account of the fact that the outstanding balances of current accounts at the Bank will increase on an aggregate basis as the asset purchases progress under “QQE with a Negative Interest Rate.”

Banks that manage their reserves cleverly will be able to avoid the negative rate on most of their reserves. Indeed, this seems to be the Bank of Japan’s intention, according to a footnote:

A multiple-tier system is intended to prevent an excessive decrease in financial institutions’ earnings stemming from the implementation of negative interest rates that could weaken their functions as financial intermediaries.

Those who think that the purpose of negative rates is to encourage banks to lend are now no doubt muttering darkly about bank lobbying and “revolving doors”. But the negative rate is not about bank lending. It is in fact a further strengthening of Japan’s “quantitative and qualitative easing” (QQE) programme:

The Bank will lower the short end of the yield curve by slashing its deposit rate on current accounts into negative territory and will exert further downward pressure on interest rates across the entire yield curve, in combination with large-scale purchases of JGBs.

And just in case this is not clear, the Bank of Japan explains in a footnote that the purpose of the negative rate is to influence market prices (my emphasis):

A negative interest rate is expected to exert its intended effects on financial markets even under the multiple-tier system where a negative interest rate is applied partially. Transaction prices in financial markets (e.g. interest rates, stock prices, and exchange rates) are determined by marginal losses or gains made in a new transaction.

Although a negative interest rate is not applied to the total outstanding balances of current accounts, costs incurred with an increase in the current account balance brought by a new transaction will be minus 0.1 percent if it is applied to a marginal increase in the current account balance. Interest rates and asset prices will be determined in financial markets based on that premise.

Thus there is no need to penalise banks heavily for holding excess reserves. The negative rate is not primarily intended to encourage banks to lend.

But why is the Bank of Japan so intent on cutting interest rates? After all, it has just produced a pretty upbeat forecast for the Japanese economy. Yes, household spending is weak, and wages are stagnant, but corporate profits are at record highs and unemployment at a record low. Inflation is hovering around zero, but that is largely because of falling oil prices, which is net positive for the Japanese economy as an oil importer. What on earth is this all about?

It’s about China, mostly:

Recently, however, global financial markets have been volatile against the backdrop of the further decline in crude oil prices and uncertainty such as over future developments in emerging and commodity-exporting economies, particularly the Chinese economy.

The external environment for Japan is becoming increasingly difficult. Central banks across South East Asia are cutting interest rates and putting downwards pressure on their currencies in response to collapsing commodity prices and China’s slowing economy. The offshore yuan (CNH) is falling, and China is progressively devaluing the onshore yuan (CNY) in response, in addition to doing various forms of yuan monetary easing. China has now broken the CNY peg to the US dollar, replacing it with a basket of currencies: since CNY is no longer pulled upwards by the US dollar, devaluation seems likely to proceed faster despite China’s tightening capital controls.

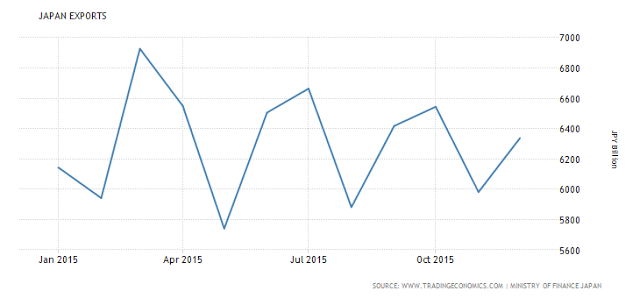

Japan’s exports are suffering from the Chinese slowdown, and from emerging market weakness generally. The trend has been downwards for the last year: