This is Jo Michell’s contribution to the EREP review of the UK economy 2015, “the Cracks Begin to Show”. The full report can be downloaded here.

In his 2015 Autumn Statement, Chancellor George Osborne gave a bravura performance. He congratulated himself on record growth and employment, falling public debt, surging business investment and a narrowing trade deficit. He announced projections of continuous growth and falling public debt over the next parliament.

While much of this was a straightforward misrepresentation of the facts — capital investment has yet to recover from the 2008 crisis and the current account deficit continues to widen — other sound bites came courtesy of the Office for Budget Responsibility. The OBR delivered the Chancellor an early Christmas present in the form of a set of revised projections showing better-than-expected public finances over the next five years.

When, previously, the OBR inconveniently delivered negative revisions, the Chancellor responded by pushing back the date he claims he will achieve a budget surplus. In response to the OBR’s gift, however, he chose instead to spend the windfall. This is a risky strategy because any negative shock to the economy means he will miss his current fiscal targets — targets he has already missed repeatedly since coming to office.

As it turns out, these negative shocks have materialised rather quickly. Since the Chancellor made his statement a month ago, UK GDP growth has been revised down, the trade deficit has widened and estimates of borrowing for the current year have increased.

In reality, the OBR projections never looked plausible. The UK’s current account deficit — the amount borrowed each year from the rest of the world — is at an all- time high of around 5% of GDP. Every six months for the last three years, the OBR forecast that the deficit would start to close within a year; every time they were proved wrong. Their current assertion — that the trend will be broken in 2016 and the deficit will steadily narrow to around 2% of GDP in 2020 — must be taken with a large pinch of salt.

The current account deficit measures the combined overseas borrowing of the UK public and private sectors. In the unlikely event that George Osborne was to achieve his stated aim of a budget surplus, the whole of this foreign borrowing would be accounted for by the private sector. This is exactly what the OBR is projecting. Specifically, they predict that the household sector will run a deficit of around 2% per year for the next five years. They note that “this persistent and relatively large household deficit would be unprecedented”.

This projection has been the basis of recentstories in the press which have declared that the Chancellor has set the economy on a path to almost-certain financial meltdown within the current parliament. This is too simplistic an analysis. Financial imbalances can persist for a long time. The last UK financial crisis originated not in the US UK lending markets but in UK banks’ exposure to overseas lending.

But the Chancellor’s strategy entails serious financial risks. Even though there is no real chance of achieving a surplus by 2020, further cuts to government spending will squeeze spending out of the economy, placing ever more of the burden on household consumption spending to maintain growth.

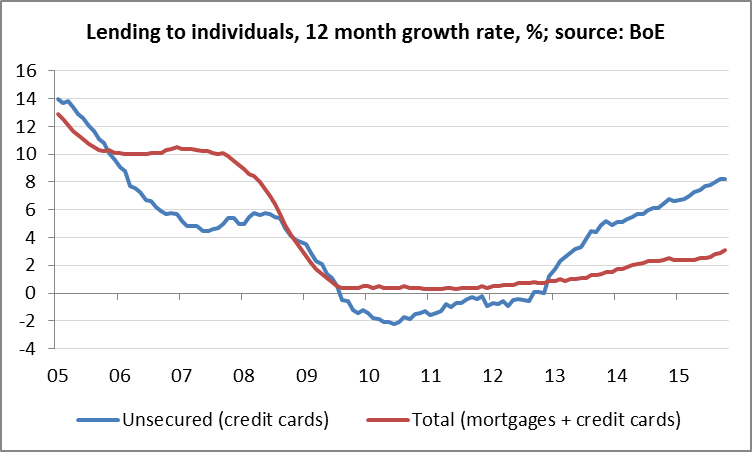

The figure below shows the annual growth in lending to households. While total credit growth remains subdued, unsecured lending has, in the words of Andy Haldane, chief economist at the Bank of England, been “picking up at a rate of knots”.

Moderate growth in the mortgage market may conceal deeper problems: household debt-to-income ratios have fallen since the crisis but, at around 140% of GDP, remain high both in historical terms and compared to other advanced nations. The majority of new mortgage lending since 2008 has been to buy-to-let landlords. These speculative buyers now face the prospect of rising interest rates and tax changes that will take a large chunk out of their property income. Many non-buy-to-let borrowers are badly exposed: a sixth of mortgage debt is held by those who have less than £200 a month left after spending on essentials.

The Financial Policy Committee has noted that these trends “… could pose direct risks to the resilience of the UK banking system, and indirect risks via its impact on economic stability”.

What is often left out of the more apocalyptic visions of a coming credit meltdown is that underlying all this is an unprecedented housing crisis in which an entire generation are locked out of home ownership Instead of tackling this crisis, Osborne is using the housing market as a casino in the hope of keeping economic growth on track during another five years of austerity. It is a high-risk strategy. His luck may soon run out.